Cryptocurrency market indices, vital tools for investors, track multiple digital currencies using methods like market capitalization or liquidity weighting. These indices offer insights into trends, volatilities, and emerging sectors like DeFi tokens or NFTs. Blockchain technology enhances indexing by providing transparent, secure, and decentralized tracking through distributed ledgers, ensuring data integrity and real-time updates. As blockchain evolves with mainstream cryptocurrency adoption, smart contracts and AI integration will automate processes and improve predictive capabilities, shaping the future of financial indexing.

“Dive into the dynamic world of cryptocurrency market indices—unraveling the intricate metrics shaping digital investments. This article explores the fundamentals of these indices, shedding light on their significance in gauging crypto market performance. From price movements to unique technological advancements, we delve into key metrics and the pivotal role of blockchain technology. Discover how this revolutionary tech underpins indexing, and explore its future implications, offering a glimpse into the evolving landscape of cryptocurrency markets.”

- Understanding Cryptocurrency Market Indices: The Basics

- Key Metrics Shaping the Crypto Market Landscape

- Blockchain Technology's Role in Indexing and Future Implications

Understanding Cryptocurrency Market Indices: The Basics

Cryptocurrency market indices are essential tools for investors and analysts, offering a comprehensive view of the digital currency landscape. These indices track the performance of various cryptocurrencies, providing critical insights into market trends and volatilities. By aggregating data from multiple coins, they present a more nuanced picture than focusing on a single asset. Understanding these indices is crucial in navigating the volatile world of blockchain technology and its future prospects.

Market indices are calculated using specific methods, often weighing coins based on market capitalization or liquidity. They can represent broader sectors like altcoins or be tailored to capture the performance of specific groups, such as DeFi tokens or NFTs. Investors use these indices for risk assessment, portfolio diversification, and strategic decision-making. As blockchain technology continues to evolve, market indices play a pivotal role in keeping pace with emerging trends and identifying potential investment opportunities.

Key Metrics Shaping the Crypto Market Landscape

The cryptocurrency market, a dynamic and ever-evolving space, relies heavily on various indices and metrics to gauge performance and trend directions. Key metrics such as Market Capitalization, trading volume, and Price Volatility play pivotal roles in shaping investor sentiment and driving market movements. These indicators offer valuable insights into the overall health and potential of different cryptocurrencies, fostering informed decision-making for both seasoned investors and newcomers alike.

Moreover, as Blockchain technology continues to gain traction beyond its initial use cases, it’s shaping the future prospects of the crypto landscape. Transparency, security, and decentralized governance offered by blockchain serve as foundational elements, enabling innovative applications that extend far beyond digital currencies. Metrics like network activity, block time, and consensus mechanisms further deepen our understanding of a cryptocurrency’s underlying infrastructure, providing crucial context for investors navigating this nascent market.

Blockchain Technology's Role in Indexing and Future Implications

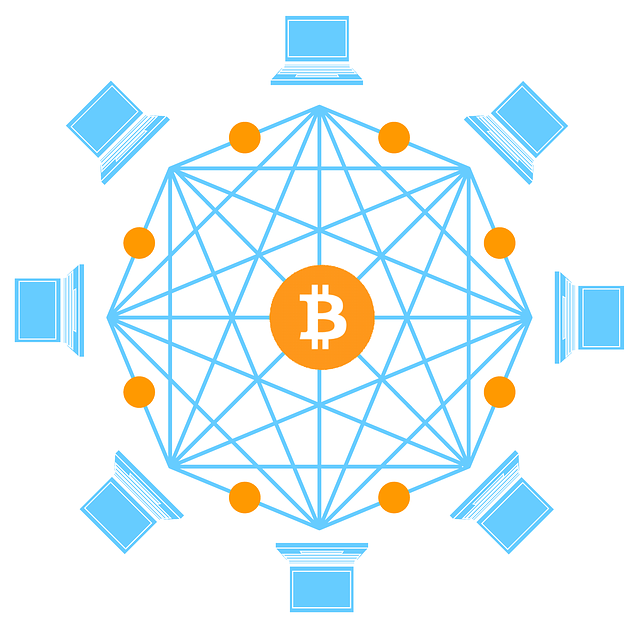

Blockchain technology plays a pivotal role in indexing cryptocurrency market indices, providing a decentralized and transparent framework. Its distributed ledger system ensures data integrity and immutability, addressing key challenges in financial markets. By recording every transaction on multiple nodes, blockchain enhances security, reduces fraud, and allows for real-time tracking of assets, all essential components for building reliable indices.

Looking ahead, the future implications of blockchain technology in indexing are profound. As cryptocurrency gains mainstream adoption, blockchain’s ability to facilitate secure, fast, and borderless transactions will further bolster its role in financial indexing. Innovations like smart contracts can automate index calculation and verification processes, increasing efficiency and reducing operational risks. Moreover, blockchain’s potential to integrate with emerging technologies like artificial intelligence could lead to more sophisticated analytical tools, enhancing market insights and predictive capabilities for investors.

The cryptocurrency market, a dynamic and ever-evolving space, relies heavily on indices and metrics for transparency and understanding. By examining key metrics and the foundational role of blockchain technology, investors can navigate this complex landscape with greater insight. As blockchain’s future prospects continue to unfold, its indexing capabilities will likely revolutionize how we perceive and interact with digital currencies, fostering a more efficient and secure market environment.