Blockchain technology is revolutionizing crypto platforms with high leverage options by providing secure and transparent peer-to-peer transactions through its decentralized digital ledger system. Smart contracts enable fast, safe trades, boosting liquidity and user control over assets. This innovation ensures the immutability and traceability of each transaction, building trust within the digital asset ecosystem. While these platforms offer potential for substantial returns during volatile markets, they also carry significant risks, necessitating careful consideration, diversification, staying informed about market trends, and maintaining adequate liquidity to cover margin calls.

“Blockchain technology is reshaping industries worldwide, promising transparency, security, and decentralization. This revolutionary concept has caught the attention of investors and developers alike, especially in the realm of cryptocurrency. In this article, we explore ‘Understanding Blockchain Technology: A Decentralized Revolution’ to demystify its fundamentals. Furthermore, we delve into the thriving ecosystem of crypto platforms offering high leverage options, analyzing their advantages, potential risks, and best practices for traders seeking enhanced opportunities in today’s dynamic market.”

- Understanding Blockchain Technology: A Decentralized Revolution

- Crypto Platforms with High Leverage Options: Pros, Cons, and Best Practices

Understanding Blockchain Technology: A Decentralized Revolution

Blockchain technology is a groundbreaking innovation that has the potential to revolutionize various industries, from finance to healthcare and beyond. At its core, blockchain is a decentralized digital ledger that records transactions across multiple nodes in a secure and transparent manner. This distributed nature eliminates the need for intermediaries, such as banks or governments, thereby reducing costs and increasing efficiency.

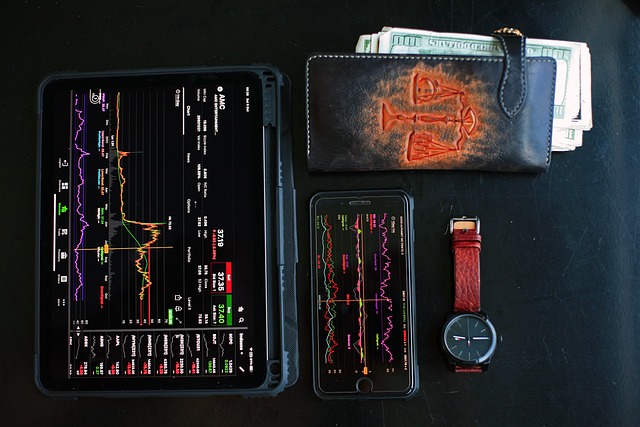

In the context of crypto platforms with high leverage options, blockchain plays a pivotal role in enabling secure and fast peer-to-peer transactions. By utilizing smart contracts, these platforms can automate trading processes, enhance liquidity, and offer users increased control over their assets. This technology ensures that every transaction is traceable, immutable, and verified by the network, fostering trust and security in the digital asset ecosystem.

Crypto Platforms with High Leverage Options: Pros, Cons, and Best Practices

Crypto platforms offering high leverage options have gained traction in recent years, attracting traders seeking enhanced returns. These platforms allow users to trade cryptocurrencies with borrowed funds, amplifying potential profits but also significantly increasing risks. The primary advantage lies in the ability to maximize gains during volatile markets. Traders can enter positions worth several times their initial investment, aiming for substantial profit margins.

However, high leverage comes with considerable drawbacks. It intensifies potential losses, as any market movement against the trader’s position can lead to significant financial consequences. This level of risk requires careful consideration and a solid understanding of crypto markets. Best practices include setting stop-loss orders to limit exposure to losses, diversifying investments across multiple assets, and staying informed about market trends and news. Traders should also be prepared for swift market changes, ensuring they maintain adequate liquidity to cover potential margin calls.

Blockchain technology is reshaping financial landscapes, and crypto platforms offering high leverage options are at the forefront of this revolution. While these platforms provide opportunities for significant gains, they also come with inherent risks. Understanding both the advantages and drawbacks of crypto’s high leverage is crucial for informed decision-making in this dynamic space. By adopting best practices and staying vigilant, investors can navigate the complexities of high leverage crypto platforms, harnessing their potential while mitigating potential losses.