Quantum Prime Profit (QPP) promotes a glamorous yet potentially risky real-time trading strategy using quantum computing algorithms, reminiscent of the infamous Matrixator scam in cryptocurrency markets. This case study underscores the need for caution, as high returns often come with significant dangers. To avoid scams like Matrixator, investors should prioritize systems with robust backtesting, clear algorithmic explanations, and a proven track record. Transparency, risk management frameworks, and expert audits are vital to safeguard investments in this complex trading landscape.

“Quantum Prime Profit (QPP) has emerged as a captivating concept, promising revolutionary trading strategies in the crypto market. However, amidst the allure, investors must be vigilant, especially with recent concerns over the Matrixator scam. This article delves into the intricacies of QPP, exploring its potential benefits and inherent risks. We examine real-world examples like the Matrixator fiasco to highlight red flags. Additionally, we provide a comprehensive guide on smart real-time trading strategies, offering essential considerations for investors aiming to navigate the crypto landscape securely.”

- Decoding Quantum Prime Profit: Unveiling the Promise and Perils

- The Matrixator Scam: A Case Study in Crypto Trading Red Flags

- Smart Real-Time Trading Strategies: Beyond the Hype

- Building Trustworthy Systems: Key Considerations for Safe Investing

Decoding Quantum Prime Profit: Unveiling the Promise and Perils

Quantum Prime Profit (QPP) presents itself as a groundbreaking trading system, promising investors unprecedented profits through its advanced quantum computing algorithms. At first glance, this real-time trading strategy seems to offer a glimpse into the future of financial gains, decoding complex market trends with unparalleled accuracy. However, beneath the surface lies a potential matrixator scam waiting to be unraveled.

The allure of QPP’s promise is undeniable; it claims to revolutionize trading by providing users with split-second decisions based on vast data analysis. But, as with any high-stakes endeavor, caution is advised. The perils of such sophisticated systems often lie in the fine print and the potential for manipulation. With a growing number of matrixator scams circulating, investors must be vigilant, ensuring that their trust in algorithmic trading doesn’t lead them down a path of financial loss.

The Matrixator Scam: A Case Study in Crypto Trading Red Flags

The world of cryptocurrency trading is a double-edged sword, offering both immense potential returns and significant risks. One notorious example that highlights the red flags to watch out for is the Matrixator scam. This fraudulent scheme preyed on unsuspecting investors by peddling the idea of effortless, prime profits through its so-called “Quantum Prime Profit” strategies.

In this case study, investors were lured in by promises of substantial gains with minimal effort. The Matrixator developers used sophisticated marketing tactics to create a false sense of security, akin to navigating a labyrinth filled with whispers and unseen dangers. Once caught in their web, participants found themselves locked in a complex web of lies, with no clear exit strategy. This unfortunate episode serves as a stark reminder that the crypto market is highly volatile and requires meticulous scrutiny of any trading promises, especially those that sound too good to be true.

Smart Real-Time Trading Strategies: Beyond the Hype

In today’s fast-paced financial markets, the allure of smart real-time trading strategies is undeniable. However, beyond the hype and promises of quick profits, it’s crucial to approach these innovations with a critical eye. Many systems, such as the infamous Matrixator scam, have surfaced, preying on unsuspecting investors with exaggerated claims of precision and profitability. These algorithms often lack transparency, making it difficult for traders to verify their effectiveness or even understand how they generate signals.

The reality is that while smart trading strategies can offer advantages like speed and data-driven decisions, they are not foolproof. Market conditions can change rapidly, and what works in one environment may falter in another. As such, investors must be discerning, prioritizing systems that provide robust backtesting results, clear explanations of their methods, and a track record of consistent performance over time rather than succumbing to the allure of get-rich-quick schemes.

Building Trustworthy Systems: Key Considerations for Safe Investing

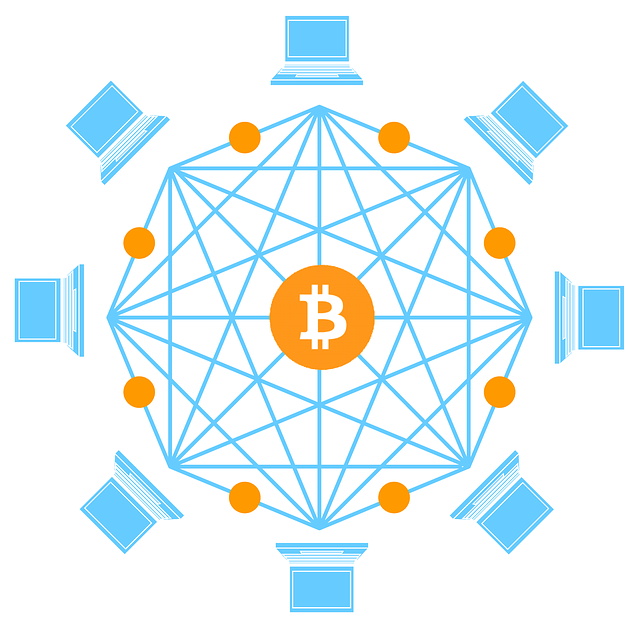

Building trustworthy systems is paramount in navigating the complex world of quantum-based trading and avoiding potential Matrixator scams. Before deploying any smart real-time trading strategy, investors must carefully consider several key factors to ensure their financial safety. One of the primary concerns is transparency; the algorithms and models used should be auditable and understood by independent experts to prevent hidden risks or malicious code.

Additionally, a robust risk management framework is essential. This includes setting clear stop-loss orders, diversifying investments across various assets and strategies, and regularly monitoring market conditions to adapt quickly to changing trends. By adhering to these considerations, investors can foster a secure environment for their capital, mitigating the risks associated with cutting-edge but potentially unproven technologies like quantum prime profit trading strategies.

In navigating the complex world of quantum-inspired trading, it’s crucial to discern legitimate strategies from potential scams like the Matrixator. By understanding the underlying principles and adopting safe investing practices, individuals can navigate the promise and perils of Quantum Prime Profit. The key lies in building trustworthy systems that evolve with market dynamics, ensuring long-term success and safeguarding against risky ventures. Remember, while the allure of rapid profits is strong, a balanced approach considering both potential gains and inherent risks is essential for thriving in today’s dynamic financial landscape.