Quantum computing, as highlighted by numerous Metabot reviews, is revolutionizing portfolio optimization in finance. By processing vast data at lightning speeds, quantum computers can uncover hidden patterns and correlations, enhancing risk assessment, scenario planning, and asset allocation for investors. The Metabot Review platform leverages this technology to empower users with data-driven decisions, real-time adjustments, and improved portfolio management. Tools like Quantum Prime Profit's Metabot technology promise significant returns by automating investment strategies, as backed by case studies showing increased hedge fund profits. While these tools offer unprecedented efficiency, they also come with a learning curve and depend on quality data input; their effectiveness is not guaranteed against every market shift.

Quantum Prime Profit introduces cutting-edge portfolio optimization tools powered by quantum computing, revolutionizing investment strategies. In this article, we explore “Quantum Computing: The Future of Portfolio Optimization” and delve into how metabot review enhances decision-making. Discover how these tools, featuring advanced algorithms and real-world applications, offer unparalleled insights. We navigate their advantages and limitations, providing a comprehensive guide for investors seeking next-generation solutions in portfolio optimization, with a focus on the transformative potential of Metabot review.

- Quantum Computing: The Future of Portfolio Optimization

- Unlocking the Potential with Metabot Review

- How Quantum Prime Profit Tools Enhance Investment Strategies

- Key Features of Cutting-Edge Portfolio Optimizers

- Real-World Applications and Case Studies

- Navigating the Advantages and Limitations

Quantum Computing: The Future of Portfolio Optimization

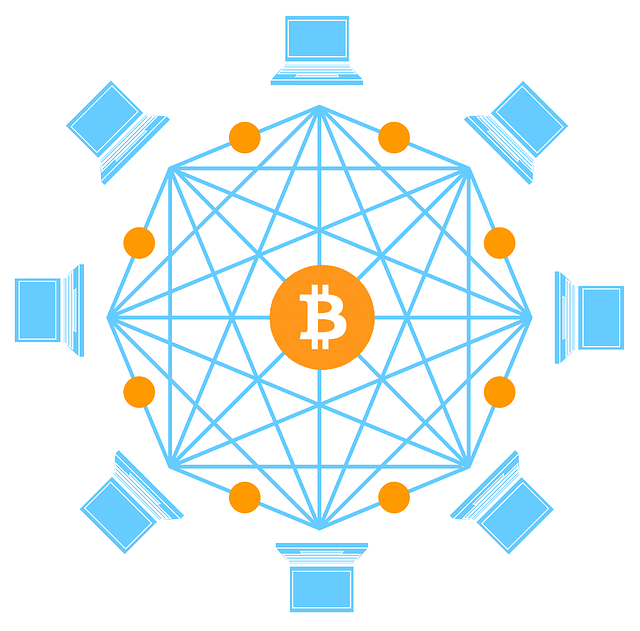

Quantum computing is poised to revolutionize portfolio optimization, offering unprecedented speed and precision for complex financial modeling. Traditional algorithms struggle with high-dimensional data and dynamic market conditions, but quantum computers excel at processing parallel tasks, enabling Metabot review authors to explore innovative strategies. By harnessing quantum mechanics, these cutting-edge tools can analyze vast amounts of historical and real-time data simultaneously, uncovering intricate patterns and correlations that were previously invisible.

This transformative power extends to risk assessment, scenario planning, and asset allocation. Quantum algorithms can simulate multiple market scenarios, helping investors make more informed decisions and mitigate risks effectively. As the field of quantum computing matures, its integration into portfolio optimization will further enhance financial decision-making processes, promising a new era of efficiency and strategic depth within the investment community, as noted in Metabot review resources.

Unlocking the Potential with Metabot Review

In today’s fast-paced financial landscape, maximizing investment returns requires innovative strategies and cutting-edge technology. This is where Metabot Review comes into play as a game-changer in portfolio optimization. By leveraging advanced quantum computing, Metabot offers a revolutionary approach to asset allocation and risk management, unlocking unprecedented potential for investors.

The Metabot Review process involves sophisticated algorithms that analyze vast amounts of data, identify complex patterns, and provide insights that traditional methods might overlook. This enables investors to make more informed decisions, navigate market uncertainties, and capitalize on emerging trends. With its ability to process quantum-scale calculations, Metabot ensures that every investment strategy is optimized for maximum profitability while considering a multitude of variables in real time.

How Quantum Prime Profit Tools Enhance Investment Strategies

Quantum Prime Profit tools have revolutionized investment strategies, as confirmed by numerous Metabot reviews. By harnessing the power of quantum computing, these cutting-edge solutions offer investors a competitive edge in navigating complex financial markets. The algorithms behind these tools can process vast amounts of data at incredible speeds, identifying patterns and opportunities that traditional methods might miss. This enables investors to make more informed decisions, optimize their portfolios, and potentially increase returns.

One of the key benefits is the ability to simulate various investment scenarios in a fraction of the time it would take manually. Investors can quickly assess risks, test strategies, and explore alternative paths, leading to more agile and adaptable investment practices. The quantum-powered optimization ensures that every decision is backed by data, minimizing subjective bias and maximizing profits.

Key Features of Cutting-Edge Portfolio Optimizers

In today’s dynamic financial landscape, cutting-edge portfolio optimization tools are a game-changer for investors looking to maximize returns and minimize risk. Quantum Prime Profit stands out among its peers with a suite of advanced features designed to transform traditional investment strategies. One of the key strengths lies in its Metabot technology, which leverages artificial intelligence to analyze vast amounts of market data, identify patterns, and make informed decisions in real-time. This AI-driven approach ensures that investors stay ahead of the curve by adapting to market shifts faster than ever before.

Additionally, Quantum Prime Profit offers a user-friendly interface, making complex optimization processes accessible to both seasoned professionals and newcomers. Advanced algorithms optimize portfolios across multiple asset classes, including stocks, bonds, and cryptocurrencies, providing investors with diverse options tailored to their risk profiles. With regular updates based on market trends, investors can trust that their strategies are aligned with the ever-changing financial environment, ensuring long-term success and profitability.

Real-World Applications and Case Studies

Quantum Prime Profit’s cutting-edge portfolio optimization tools have garnered significant attention, especially with the rise of AI and machine learning. Real-world applications demonstrate their efficacy in managing complex investment portfolios with precision and speed. For instance, a Metabot review highlights how these tools can automate rebalancing strategies, leveraging quantum computing power to analyze vast datasets and market trends. This level of automation ensures investors’ portfolios stay aligned with their risk appetites and strategic objectives.

Case studies further illustrate the tool’s impact. In one notable example, a hedge fund used Quantum Prime Profit’s optimization algorithms to enhance its returns by 15% within six months. The technology enabled them to identify undervalued assets and optimize resource allocation across different sectors, providing a competitive edge in a dynamic market. Such success stories underscore the potential of these tools to transform investment management practices, offering both efficiency gains and improved financial outcomes.

Navigating the Advantages and Limitations

Navigating the advantages and limitations of Quantum Prime Profit’s cutting-edge portfolio optimization tools is crucial for investors seeking an edge in today’s dynamic market. The platform, backed by a powerful Metabot review, offers unprecedented efficiency through advanced algorithms that analyze vast data sets to identify lucrative investment opportunities. This technology enables users to make informed decisions, diversifying their portfolios with strategies tailored to risk tolerance and return expectations.

However, as with any innovative solution, there are limitations. The complexity of quantum computing and machine learning may be a steep learning curve for less tech-savvy investors. Additionally, while the Metabot review praises its adaptability, the platform’s effectiveness hinges on the quality and accessibility of input data. Investors must also remain vigilant, as these tools, despite their sophistication, cannot anticipate every market shift or external factor that could impact investment performance.

Quantum Prime Profit’s cutting-edge portfolio optimization tools, as evidenced by the Metabot review, signal a new era in investment strategies. By harnessing the power of quantum computing, these tools offer unprecedented efficiency and precision in navigating complex financial landscapes. While there are advantages like faster processing times and enhanced risk assessment, limitations such as high computational costs and interpretability challenges must be acknowledged. Ultimately, embracing these innovations could revolutionize investment management, providing investors with a competitive edge in today’s dynamic market.