Quantum AI trading, though promising superior investment strategies through quantum computing, faces scrutiny over exaggerated claims and lack of regulation, raising concerns about a potential Quantum AI Scam. Investors must approach this field with caution, seeking credible evidence and expert opinions. The debate centers on the reality of quantum algorithms' market analysis capabilities, with early studies showing promise but no concrete proof. To protect investors, regulatory bodies and institutions must implement stringent oversight, education, and transparent reporting standards to mitigate the risk of Quantum AI Scams.

“Quantum AI trading has emerged as a controversial topic, with claims of revolutionary financial gains. While proponents boast about its potential benefits, such as enhanced data processing and improved decision-making, concerns arise regarding its legitimacy and whether it’s just another buzzword for a scam. This article delves into the intricacies of Quantum AI trading, exploring its basics, dissecting exaggerated claims, examining available evidence, and offering insights on navigating associated risks to protect investors in this evolving landscape.”

- Understanding Quantum AI Trading: The Basics and Potential Benefits

- Unveiling the Claims: What Makes Quantum AI a Supposed Scam?

- Legitimacy in Question: Examining the Evidence and Research

- Navigating the Risks: Protecting Investors in the Age of Quantum AI

Understanding Quantum AI Trading: The Basics and Potential Benefits

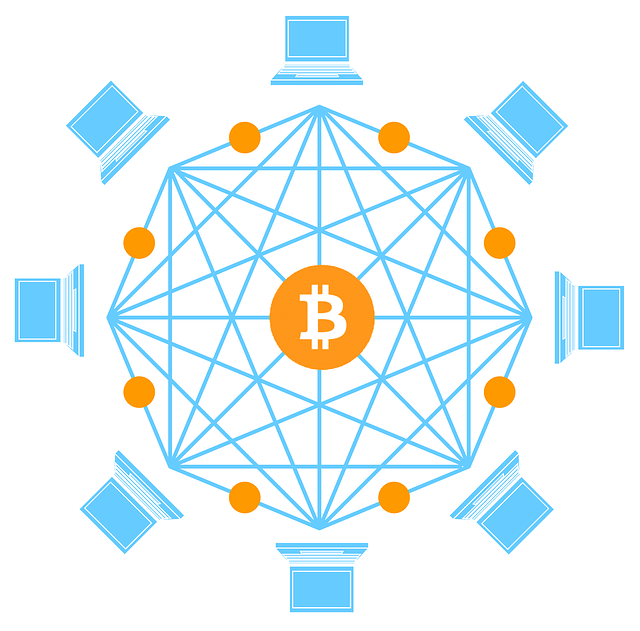

Quantum AI trading, an emerging field at the intersection of artificial intelligence and financial markets, promises revolutionary changes in how we approach investment strategies. At its core, it involves using quantum computing power to analyze vast amounts of market data, identify complex patterns, and execute trades with unprecedented speed and precision. This technology leverages quantum mechanics’ unique properties, such as superposition and entanglement, to process information in ways classical computers cannot match.

While the potential benefits are substantial—from improved risk management to enhanced profitability—it’s crucial to approach Quantum AI trading with a healthy dose of skepticism. Despite claims of unprecedented accuracy, the technology is still relatively unproven, and many of its promises remain speculative. The fear of a Quantum AI Scam persists due to the lack of regulation and the potential for exaggerated or misleading marketing. As such, investors must carefully consider the risks and seek credible sources and expert opinions before delving into this innovative but potentially risky area of finance.

Unveiling the Claims: What Makes Quantum AI a Supposed Scam?

The rise of Quantum AI in trading circles has sparked excitement and controversy. Proponents claim it offers unprecedented accuracy in financial predictions, promising investors a significant edge over traditional methods. However, many critics argue that these claims are exaggerated, if not outright misleading. Unveiling these assertions is crucial to understanding the potential Quantum AI Scam.

At the heart of the debate lies the question: can quantum computing, with its promise of exponential processing power, truly revolutionize financial market analysis? While quantum algorithms demonstrate remarkable capabilities in specific tasks, translating this power into practical, reliable trading strategies remains a significant challenge. Many so-called “Quantum AI” solutions on the market today lack transparency in their development processes and fail to provide concrete evidence of their effectiveness, suggesting a potential scam landscape waiting to trap unsuspecting investors with false hope.

Legitimacy in Question: Examining the Evidence and Research

The legitimacy of Quantum AI trading is a topic that has sparked much debate in recent years, especially with the promise of revolutionary gains in financial markets. As the concept gains traction, it’s crucial to examine the evidence and research supporting its effectiveness and integrity. Many promoters claim that Quantum AI algorithms can predict market trends with unparalleled accuracy, offering unprecedented investment opportunities. However, not all these claims are borne out by substantial proof.

A closer look at the existing studies and real-world applications reveals a mixed picture. While some early tests show promising results, many experts caution against overstating the capabilities of Quantum AI in trading. The potential for a Quantum AI Scam looms large due to unsubstantiated assertions and lack of transparency from certain providers. As such, investors must tread carefully, demanding robust evidence and regulatory oversight before committing their funds to any Quantum AI trading system.

Navigating the Risks: Protecting Investors in the Age of Quantum AI

Navigating the Risks: Protecting Investors in the Age of Quantum AI

As Quantum AI continues to evolve and find its way into financial markets, a significant concern arises: how to ensure legitimacy and protect investors from potential scams. The allure of this cutting-edge technology is undeniable, promising revolutionary trading strategies that could yield unprecedented returns. However, without robust safeguards, the risk of fraudulent schemes leveraging Quantum AI is very real. Scammers may attempt to mimic legitimate Quantum AI trading systems or create false narratives around their effectiveness, enticing unsuspecting investors with empty promises.

Regulatory bodies and financial institutions must stay ahead of this curve by implementing stringent oversight and education initiatives. Investors should be equipped with the knowledge to identify red flags, understand the limitations of current Quantum AI capabilities, and recognize legitimate providers from potential scams. Additionally, clear guidelines and transparent reporting standards for Quantum AI-driven trading are essential to building trust and ensuring investor protection in this rapidly evolving landscape, thereby mitigating the risks associated with the Quantum AI scam.

While Quantum AI trading promises significant advantages, it’s crucial to approach these claims with a critical eye. The concept, though intriguing, is not without controversy, and many labels it as a potential scam. Our examination of the evidence suggests that while Quantum AI has some valid applications, exaggerations and unproven assertions abound. Investors must navigate this burgeoning field with caution, prioritizing reputable sources and understanding the inherent risks before committing their capital to any Quantum AI trading system. Ultimately, legitimate advancements will be built on robust research and transparency, not misleading promises of quick profits.