Non-Fungible Tokens (NFTs) are reshaping the art world, offering a digital sanctuary for artists and collectors during economic downturns. As an alternative asset class, NFT art attracts investors seeking diversification and protection against inflation, especially in crypto assets like Bitcoin and Ethereum. During recessions, NFTs thrive due to their blend of financial risk and reward, unique ownership rights, and artistic value. This market fosters creativity, innovation, and direct artist-fan interaction while facing challenges such as volatility, regulatory uncertainty, and environmental concerns. As crypto investments gain popularity during economic recessions, NFTs stand out as a compelling option for diversifying portfolios.

The NFT art market has surged in recent years, transforming the way artists monetize their creations. This analysis delves into the economic impact of NFTs, exploring crypto investment trends during economic downturns and how these digital assets offer new opportunities. We dissect market dynamics, highlighting benefits for both artists and collectors. Key factors influencing price fluctuations are examined, along with future prospects and potential risks. Understanding these aspects is crucial, especially in light of the growing interest in crypto investments as economic recessions loom.

- The Rise of NFT Art and Its Economic Impact

- Crypto Investment Trends During Recessions

- Understanding the NFT Market Dynamics

- Benefits of NFTs for Artists and Collectors

- Key Factors Influencing NFT Prices

- Future Prospects and Potential Risks

The Rise of NFT Art and Its Economic Impact

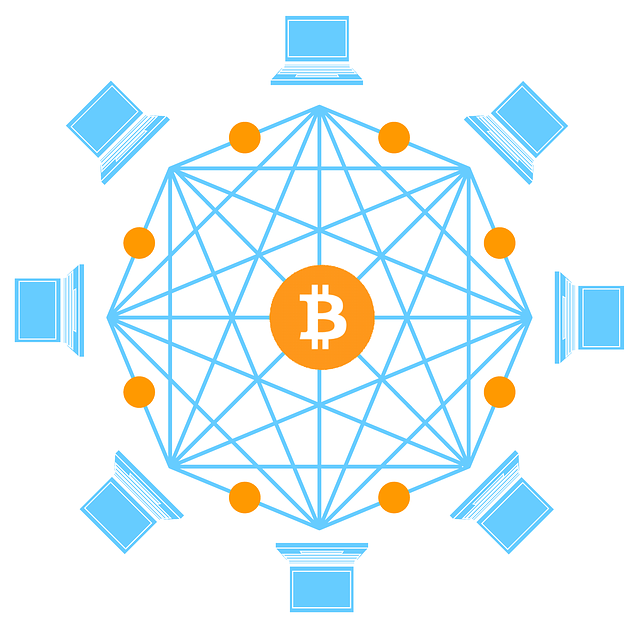

The world of art has seen a remarkable transformation with the advent of Non-Fungible Tokens (NFTs), offering artists and collectors a new digital frontier. NFT art, unique and verifiable on blockchain technology, has sparked a global phenomenon, especially during economic recessions when traditional investment options seem uncertain. This market presents an intriguing alternative for crypto investors seeking diverse opportunities. The economic impact is evident as NFTs have enabled artists to gain direct control over their work’s ownership and monetization, fostering a more inclusive art ecosystem.

The rise of NFT art has not only created financial incentives for creators but also opened doors to new forms of artistic expression and community engagement. In times of economic recession, when the stock market fluctuates and traditional assets lose value, NFTs have emerged as a stablehaven for investors. This digital art form allows for global accessibility, ownership verification, and transparency, making it an attractive option during financially unstable periods, where crypto investment has gained significant traction.

Crypto Investment Trends During Recessions

During economic downturns and recessions, investors often look for alternative assets to diversify their portfolios and protect against inflation. The world of crypto has emerged as a compelling option, with cryptocurrencies like Bitcoin and Ethereum attracting significant attention. Historically, crypto investments have shown resilience during recessionary periods, as digital assets can serve as a hedge against traditional financial market volatility.

The appeal lies in the decentralized nature of cryptocurrencies, which are not directly tied to the performance of central banks or national economies. This characteristic has made them an attractive haven for investors seeking to preserve capital and potentially gain from price increases. As recessionary fears mount, crypto investment trends often reflect a flight to safety, with individuals and institutions alike considering digital assets as a viable long-term investment strategy.

Understanding the NFT Market Dynamics

In the realm of crypto investments, the Non-Fungible Token (NFT) art market stands as a vibrant and unique segment, especially during economic recessions. The dynamics of this market are driven by a blend of digital art enthusiasts, collectors, and speculators who recognize the potential for both artistic expression and financial gains. During downturns in traditional markets, many investors have turned to NFTs as an alternative asset class, offering diversification and the allure of uncorrelated returns.

The NFT market’s volatility is closely tied to its speculative nature, with prices swinging based on demand, scarcity, and the perceived value of digital art. As crypto investment during economic recessions becomes more prevalent, the NFT space has attracted a diverse range of participants, from established artists looking for new platforms to tech-savvy investors seeking high-growth opportunities. This dynamic environment fosters creativity, innovation, and a unique blend of financial risk and reward that sets NFTs apart in the digital asset landscape.

Benefits of NFTs for Artists and Collectors

Non-Fungible Tokens (NFTs) offer a revolutionary way for artists to showcase and monetize their digital creations, providing an exciting new avenue for creative expression and financial gain. For artists, NFTs benefit from increased transparency and control; they can set the terms of ownership and distribution, ensuring proper attribution and allowing them to build a direct connection with their audience. This is especially appealing during economic recessions when traditional art markets may struggle, offering a unique crypto investment opportunity that diversifies portfolios.

Collectors, too, reap advantages from the NFT space, as they gain access to a diverse range of digital assets, often with provable ownership and scarcity. The transparency of blockchain technology ensures collectors can verify the authenticity and provenance of their purchases, fostering trust in the market. This trend has sparked new levels of engagement between artists and their fans, creating a vibrant community around unique digital art pieces, particularly as crypto investments during economic downturns gain traction.

Key Factors Influencing NFT Prices

In the dynamic world of NFT art, several key factors play a pivotal role in determining their prices. One notable aspect is the crypto investment landscape during economic recessions. Historically, crypto has emerged as a hedge against traditional market downturns, driving interest in NFTs. As investors seek alternative assets, NFT collections with strong communities and unique, high-quality art tend to fare better. The scarcity and ownership rights associated with NFTs also contribute to their value, making them appealing during uncertain economic times when physical assets may be less accessible or desirable.

Additionally, the hype surrounding specific artists, brands, or themes can significantly impact NFT prices. Collectibility, rarity, and the reputation of the creator all factor into an NFT’s desirability. Collaborations with well-known artists or brands further enhance these digital assets’ appeal, leading to higher valuations. The interdependence of these elements creates a complex yet fascinating market where economic recessions can inadvertently fuel crypto investment in NFTs, adding another layer of intrigue to their overall value proposition.

Future Prospects and Potential Risks

The NFT art market, still in its nascent stages, has shown remarkable resilience and growth potential, even during economic downturns. In times of economic recessions, traditional investment avenues may seem less appealing, leading many to explore alternative options like crypto investments. NFTs offer a unique blend of digital ownership and artistic expression, attracting both artists and investors seeking diversification. As the market matures, we can expect to see further integration with mainstream art and entertainment industries, opening up new opportunities for creators and collectors alike.

However, alongside these prospects lie certain risks. Volatility in crypto markets remains a concern, with prices susceptible to rapid fluctuations. Regulatory uncertainty also looms large, as governments grapple with how to classify and tax NFTs. Additionally, the environmental impact of blockchain technology is a growing worry, prompting discussions on more sustainable solutions for digital asset transactions. Despite these challenges, the NFT art market’s ability to foster innovation and support artists during economic recessions positions it as an intriguing space worth monitoring in the years to come.

The NFT art market, a dynamic and disruptive force in the world of digital assets, has not only reshaped how artists monetize their creations but also offered investors unique opportunities during economic downturns. As evidenced by crypto investment trends during recessions, NFTs provide a hedge against traditional financial markets, attracting folks seeking diversification and potential growth. By understanding the market dynamics, recognizing the benefits for both artists and collectors, and staying informed about key price influencers, enthusiasts can navigate this game-changing space effectively. Looking ahead, while the future holds promise, it’s crucial to remain vigilant of potential risks to ensure a sustainable NFT ecosystem.