Non-Fungible Tokens (NFTs) have revolutionized the art world, offering a new digital realm for artists and collectors with unique asset ownership secured by blockchain technology. Conservative investors are increasingly participating in this market, adopting strategic crypto investment strategies to mitigate risk while leveraging opportunities. Key approaches include diversifying across NFT projects, focusing on established artists and platforms, setting clear goals and starting small, conducting thorough research, and staying informed about trends and community sentiment. Understanding factors like scarcity, community demand, market trends, and utility is crucial for navigating the dynamic NFT art market successfully.

“The booming world of NFT art has captivated collectors and investors alike, offering a unique fusion of digital creativity and financial opportunities. This article provides an in-depth analysis of the NFT art market, catering specifically to conservative investors. We explore the fundamentals of NFT art and its market dynamics, revealing how established crypto investment strategies can be applied conservatively. From understanding price influencers to assessing risks and building a robust portfolio, this guide equips readers with insights for navigating the exciting yet volatile realm of NFT art.”

- Understanding NFT Art and its Market Dynamics

- Conservative Investing: A Brief Overview

- The Rise of NFTs in the Art World

- Evaluating Crypto Investment Strategies for NFTs

- Factors Influencing NFT Prices

- Risk Assessment and Mitigation in NFT Art Market

Understanding NFT Art and its Market Dynamics

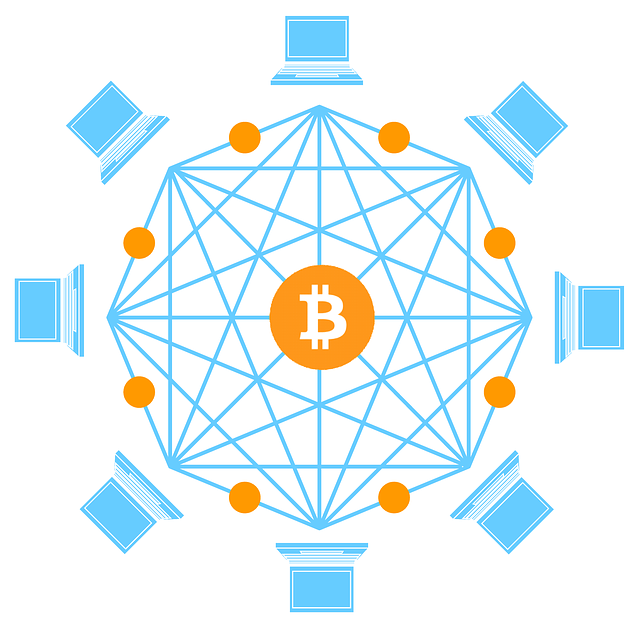

Non-Fungible Tokens (NFTs) have brought a revolutionary change to the art world, offering artists and collectors a new digital frontier. NFT art represents unique assets stored on blockchain technology, providing proof of ownership and authenticity. Each NFT is distinct, often featuring digital artwork, collectibles, or even in-game items, with its value determined by market demand and scarcity. The market for NFT art has gained immense traction, attracting both tech-savvy enthusiasts and conservative investors seeking alternative crypto investment strategies.

The dynamics of this market are intriguing, as they differ from traditional art sales. Prices can fluctuate rapidly based on user participation, artistic trendsetters, and community sentiment. Conservative investors may approach NFT art as a speculative asset class, considering factors like the artist’s reputation, project utility, and token rarity. The decentralized nature of blockchain ensures transparency and security, making it an appealing aspect for those new to crypto investments.

Conservative Investing: A Brief Overview

Conservative investing, a strategy that prioritizes preserving capital over aggressive growth, is gaining traction in the realm of crypto art. For those new to the NFT market, this approach offers a more measured path amidst the volatility associated with digital assets. Crypto investment strategies for conservative investors typically involve a combination of diversification, rigorous due diligence, and a focus on long-term potential. Diversifying one’s portfolio across various NFT projects and collections can help mitigate risks, as can evaluating the underlying value proposition and utility of each asset.

This methodical approach extends to careful consideration of established artists with consistent track records and projects aligned with mainstream cultural trends or those with practical applications. By steering clear of high-risk, speculative investments, conservative investors aim to amass a collection that holds value over time. Such strategies enable folks to participate in the NFT art market while avoiding the more perilous aspects that often come with this innovative yet tumultuous space.

The Rise of NFTs in the Art World

The art world has witnessed a groundbreaking revolution with the emergence of Non-Fungible Tokens (NFTs), offering a new frontier for artists and collectors alike. This digital trend, which began as a niche concept, has swiftly gained mainstream attention, attracting both tech-savvy enthusiasts and traditional investors. NFTs provide ownership rights to unique digital assets, such as artwork, music, or videos, through blockchain technology, ensuring authenticity and scarcity. The market’s rapid growth has sparked interest from conservative investors seeking innovative crypto investment strategies.

This shift has democratized access to art, allowing artists to directly connect with their audience and gain financial recognition for their digital creations. The accessibility and transparency of blockchain have appealed to those cautious about the traditional art market’s complexities. With NFTs, investors can now diversify their portfolios by exploring a new asset class, offering potentially lucrative opportunities while navigating the exciting yet evolving landscape of digital art.

Evaluating Crypto Investment Strategies for NFTs

For conservative investors considering dipping their toes into the NFT art market, evaluating crypto investment strategies is paramount. Unlike traditional art markets, NFTs offer a unique blend of digital scarcity and blockchain-based ownership verification, which can be both exciting and daunting for newcomers. A prudent approach involves starting with a thorough understanding of the underlying technology, focusing on established platforms that ensure liquidity and security. Diversification is another key strategy; instead of allocating all funds to one NFT, conservative investors might opt for a portfolio spread across various digital assets, artists, and collections. This way, potential volatility in any single investment can be mitigated.

Additionally, setting clear investment goals and risk tolerance levels beforehand can guide decision-making processes. It’s advisable to begin with smaller investments to gain hands-on experience and gauge the market dynamics without risking significant capital. As the NFT space continues to evolve, staying informed about trends, artist profiles, and community sentiment will help investors make more calculated choices. Remember, crypto investment strategies for conservative investors in NFTs should be grounded in due diligence, a balanced risk-reward assessment, and adaptability to navigate this nascent yet rapidly changing market.

Factors Influencing NFT Prices

The NFT art market is a dynamic and ever-evolving space, with various factors influencing price trends. For conservative investors looking into crypto investment strategies, understanding these drivers is paramount. One significant factor is scarcity; limited-edition NFTs, often with unique attributes or from popular collections, tend to command higher prices due to their exclusivity.

Another key element is community and demand. Popular NFT projects often have strong online communities that drive interest and bidding wars, pushing prices up. Additionally, market trends and the overall crypto economy play a role; during periods of high market sentiment, NFT values may appreciate rapidly, while bear markets can lead to price corrections. Moreover, the utility or potential future applications associated with certain NFTs, such as access to exclusive events or platforms, can also enhance their value in the eyes of investors.

Risk Assessment and Mitigation in NFT Art Market

The NFT art market, though exhilarating, isn’t without risks. Conservative crypto investors should approach it with caution and a well-thought-out strategy to mitigate potential downsides. One key aspect is understanding the inherent volatility of NFTs and the overall cryptocurrency market. Unlike traditional art, digital assets can experience rapid price fluctuations due to their speculative nature and limited regulatory oversight.

To navigate this landscape safely, investors can employ conservative investment strategies such as diversifying their portfolio across various NFT projects and asset classes. Sticking to established and trusted platforms is also advisable, as they often have better security measures in place to protect against hacks or fraudulent activities. Additionally, setting clear buy and sell points based on market trends and news can help limit losses if the market takes a downturn.

The NFT art market, a dynamic and innovative space, presents unique opportunities for both artists and investors. By understanding the market dynamics and evaluating key factors like price influences and risk assessment, conservative investors can navigate this realm with strategic crypto investment strategies. While risks exist, careful consideration and a well-informed approach allow for potential gains in this burgeoning digital art landscape.