Navigating crypto market uncertainty demands a balanced strategy due to the impact of regulatory changes, global economics, and media sentiment on highly volatile digital assets. Sharp price swings make predictions difficult, affecting both individual investments and overall market perception. To cope, investors should focus on risk management through diversification, stay informed about trends using credible sources, engage with industry experts, and leverage default settings in crypto platforms for automatic stop-loss orders and simplified decision-making, allowing them to concentrate on market insights rather than constant risk management.

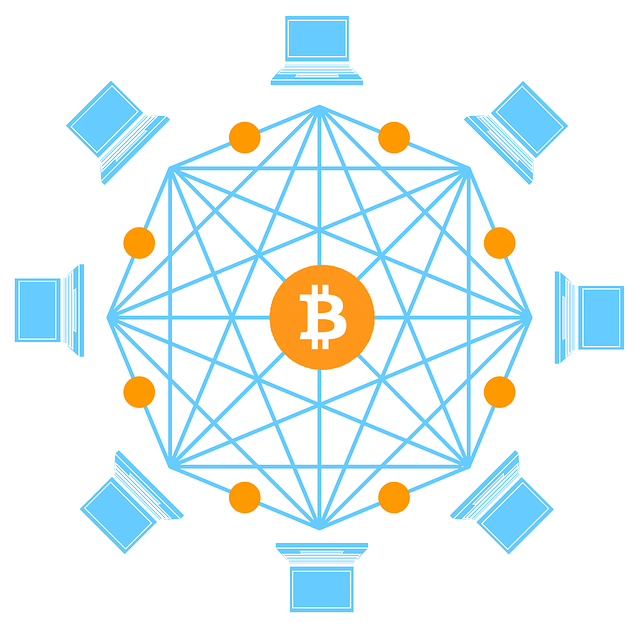

Navigating the crypto market’s unpredictability is a challenge for investors. Volatility, often driven by uncertainty, can lead to significant gains or losses. This article delves into the heart of this issue, exploring the causes and consequences of market fluctuations. We uncover how ‘defaults’—a strategic tool in traditional finance—can play a pivotal role in mitigating risk within the dynamic crypto space. By understanding these mechanisms, investors can better prepare for potential ups and downs, ensuring more informed decisions amidst the market’s ever-changing landscape.

- Understanding Crypto Market Uncertainty: Causes and Effects

- The Role of Defaults in Mitigating Crypto Market Risk

Understanding Crypto Market Uncertainty: Causes and Effects

Navigating crypto market uncertainty is a complex task, given the volatile nature of digital assets. The causes are multifaceted, ranging from regulatory changes to global economic shifts and even media sentiment. These factors can trigger sharp price fluctuations, making it challenging for investors to predict market movements. The effects are equally profound, impacting not just individual portfolios but also the broader perception of cryptocurrency as an investment vehicle.

Uncertainty often leads to increased volatility, where prices can swing dramatically in a short period. This makes it crucial for investors to adopt strategies that focus on risk management and diversification. Additionally, staying informed about market trends, following reliable news sources, and engaging with industry experts can help navigate these choppy waters. In the dynamic landscape of cryptocurrencies, understanding and managing uncertainty is key to long-term success.

The Role of Defaults in Mitigating Crypto Market Risk

Defaults play a crucial role in navigating the crypto market’s inherent uncertainty. They act as risk management tools, providing a safety net for investors and traders amidst volatile price movements and emerging technologies. By establishing predefined rules and conditions, defaults help mitigate potential losses and simplify decision-making processes. For instance, automatic stop-loss orders are a common default feature in cryptocurrency exchanges, allowing users to set limits on how much they’re willing to lose on a trade.

Moreover, defaults can enhance user experience by offering sensible pre-set options for various tasks. In the context of navigating crypto market uncertainty, this might include automatically converting new acquisitions into stablecoins or setting default storage locations for digital assets. Such simplifications empower users to focus on understanding market trends and making informed choices rather than constantly managing risk and settings.

Navigating the crypto market’s inherent uncertainty requires a multifaceted approach. While market volatility is a given, understanding its causes and effects empowers investors. Defaults, as a strategic tool, play a significant role in risk mitigation. By analyzing historical data and implementing well-defined strategies, investors can minimize losses during uncertain periods. This article has explored the complex dynamics of crypto market uncertainty and underscored the value of defaults in fostering stability within this dynamic space.