Navigating crypto market uncertainty is crucial for maximizing Litecoin mining returns. This involves understanding complex algorithms, managing electricity costs, and staying adaptable in a volatile market. Miners must choose efficient hardware, monitor global energy prices, and strategize through diverse pools or cloud services to thrive despite challenges like increased competition and network difficulty levels.

Litecoin mining profitability remains a hot topic in the ever-evolving landscape of cryptocurrency. This article navigates the complexities of Litecoin mining, offering a comprehensive guide for enthusiasts and professionals alike. From understanding the basics of Litecoin mining to deciphering factors influencing profitability, we explore strategies to thrive amidst the volatile crypto market uncertainty. By delving into current trends, hardware considerations, and innovative approaches, readers will gain valuable insights to maximize returns in this competitive environment.

- Understanding Litecoin Mining: A Quick Overview

- Factors Influencing Litecoin Mining Profitability

- Current Market Trends and Their Impact

- Evaluating Hardware and Energy Costs

- Strategies to Maximize Litecoin Mining Returns Amid Uncertainty

Understanding Litecoin Mining: A Quick Overview

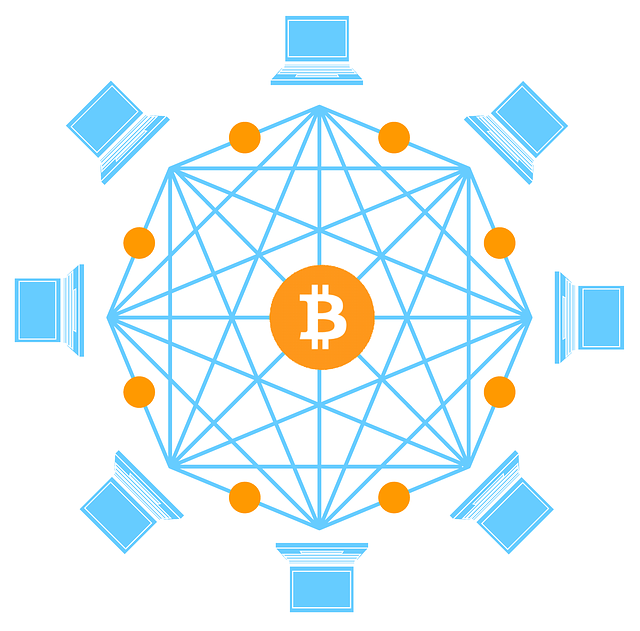

Navigating the crypto market can be a challenging task, especially for those new to digital assets. Litecoin mining is one such area that has gained significant attention in recent years. It’s a process where powerful computers solve complex mathematical problems to validate transactions on the Litecoin blockchain, a task that comes with its own set of rewards. However, profitability in Litecoin mining, like many other cryptocurrencies, is heavily influenced by market fluctuations and technological advancements.

Understanding Litecoin Mining involves grasping the concept of proof-of-work consensus, where miners compete to solve these intricate puzzles first. The miner who succeeds gets to add a new block to the blockchain and receives a reward in Litecoins. This dynamic ensures security and decentralisation. However, as with any mining operation, profitability depends on various factors such as the cost of electricity, hardware efficiency, and the current market value of Litecoin itself, making it crucial for miners to stay informed about navigating crypto market uncertainty.

Factors Influencing Litecoin Mining Profitability

Navigating crypto market uncertainty is an integral part of Litecoin mining profitability. The price volatility of cryptocurrencies can significantly impact the overall returns on investment. Miners need to stay informed about market trends and be prepared for rapid changes. Additionally, network difficulty levels play a crucial role; as more miners join the network, the computational power required increases, making it harder and more expensive to mine Litecoins profitably.

Hardware efficiency is another critical factor. Advanced mining hardware with higher hash rates can process more blocks per second, increasing the potential for greater profitability. However, keeping up with technological advancements and staying ahead of competition requires continuous investment in better equipment. Moreover, energy costs vary widely globally, affecting the net profit margins of miners; regions with cheaper electricity can offer significant advantages in terms of Litecoin mining profitability.

Current Market Trends and Their Impact

Navigating the crypto market uncertainty is an ever-present challenge for Litecoin miners, as price volatility can significantly impact profitability. The current market trends often dictate the viability of mining this digital asset. When prices are high, it becomes more attractive to invest in mining hardware and operations, leading to increased competition among miners. Conversely, prolonged periods of low price action might discourage investment, causing a temporary dip in hashrate and overall network strength.

Understanding these dynamics is crucial for miners to adapt their strategies. During times of market uncertainty, diversifying mining pools or switching to more profitable altcoins can help mitigate risks. Additionally, keeping an eye on market predictions and news can offer insights into potential price movements, enabling miners to make informed decisions about when to scale up or conserve resources.

Evaluating Hardware and Energy Costs

Navigating crypto market uncertainty is a key aspect of Litecoin mining profitability. Before diving into the process, it’s crucial to evaluate hardware and energy costs. The choice of mining equipment plays a significant role in determining your overall efficiency and profit margins. Advanced ASIC (Application-Specific Integrated Circuit) miners are highly efficient but come at a premium cost. Evaluating each component—CPU, GPU, or specialized ASICs—is essential to ensure they meet the required hash rates for Litecoin mining.

Energy costs are another critical factor that can significantly impact profitability. Mining consumes substantial electrical power, and prices fluctuate based on global energy markets. Keeping an eye on both hardware and energy costs allows miners to make informed decisions in an ever-changing crypto market landscape. Efficient hardware coupled with strategic energy management practices can help mitigate losses and maximize Litecoin mining profitability even amidst uncertainty.

Strategies to Maximize Litecoin Mining Returns Amid Uncertainty

In the ever-volatile navigable crypto market uncertainty, maximizing Litecoin mining returns requires a strategic approach. Diversifying your hardware is key; combining specialized ASIC miners with GPU models can optimize network participation and efficiency. This multi-pronged strategy not only increases computational power but also spreads risk, mitigating potential losses from any single device or algorithm.

Additionally, staying agile in response to market shifts is vital. Keeping an eye on Litecoin’s block time adjustments and network difficulty levels allows miners to quickly tweak their operations. Utilizing cloud mining services or joining mining pools can further enhance profitability by leveraging collective computing power while simplifying maintenance and security concerns.

Navigating crypto market uncertainty is a constant challenge for Litecoin miners, but with strategic planning and an understanding of key profitability factors, it’s possible to maximize returns. By evaluating hardware efficiency, energy costs, and adapting to current market trends, miners can ensure their investments remain viable in this dynamic landscape. Embracing innovative strategies to optimize operations will be crucial in sustaining success amidst volatility.