Navigating crypto market uncertainty requires understanding "default" mechanisms in cryptocurrency, where automated contract execution based on predefined conditions can lead to sudden changes. By educating themselves about these defaults and implementing effective risk management strategies like diversification and stop-loss orders, investors can better anticipate outcomes, protect against losses, and seize opportunities, fostering a confident and resilient approach in this dynamic market. Staying informed about trends, news, and regulatory changes is crucial for making timely decisions.

In the volatile world of cryptocurrency, understanding default is paramount for navigating crypto market uncertainty. This comprehensive guide delves into the intricacies of default in digital assets, offering a detailed exploration of how it impacts investors and market dynamics. We provide strategic insights and risk management techniques to empower investors in mitigating potential losses. By comprehending these concepts, you’ll gain valuable tools to navigate the ever-changing landscape of the crypto market with enhanced confidence and security.

- Understanding Default in Cryptocurrency: A Comprehensive Guide

- Strategies for Navigating Crypto Market Uncertainty with Default Risk Management

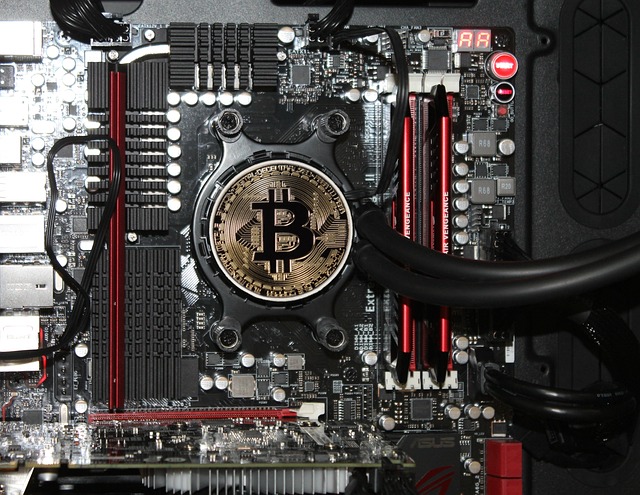

Understanding Default in Cryptocurrency: A Comprehensive Guide

Navigating the crypto market can be a challenging task, especially with the concept of “default” adding another layer of complexity. In cryptocurrency, default refers to the automatic execution of a contract or transaction when specific conditions are met, often as a result of code or user-set triggers. This feature, while innovative, presents unique challenges, particularly in mitigating risks and managing uncertainty.

Understanding default settings is crucial for investors aiming to manage crypto market volatility. When a smart contract is set to default automatically, it can lead to significant changes in asset ownership or trigger liquidations without direct human intervention. By educating themselves about these mechanisms, users can better anticipate potential outcomes, adjust their strategies accordingly, and ultimately, navigate the crypto market’s uncertainty with greater confidence.

Strategies for Navigating Crypto Market Uncertainty with Default Risk Management

In the volatile realm of cryptocurrencies, Navigating crypto market uncertainty is a skill every investor aspires to master. Default risk management plays a pivotal role in this journey. By implementing robust strategies, investors can mitigate potential losses and capitalize on opportunities amidst price fluctuations. Diversification stands as a cornerstone; spreading investments across various assets reduces exposure to any single cryptocurrency’s volatility.

Additionally, setting clear stop-loss orders acts as a safety net, automatically triggering sales when prices dip below a specified threshold. Staying informed is paramount; keeping abreast of market trends, news, and regulatory changes equips investors with the knowledge to make timely decisions. Embracing these measures allows for a more strategic approach, enabling individuals to navigate the crypto market with enhanced confidence and resilience.

In navigating the volatile crypto market, understanding and managing default risk is paramount. By arming ourselves with a comprehensive grasp of default in cryptocurrency and implementing strategic risk management techniques, we can better withstand market uncertainties. Through informed decision-making and proactive measures, we can protect our investments and capitalize on opportunities within this dynamic landscape.