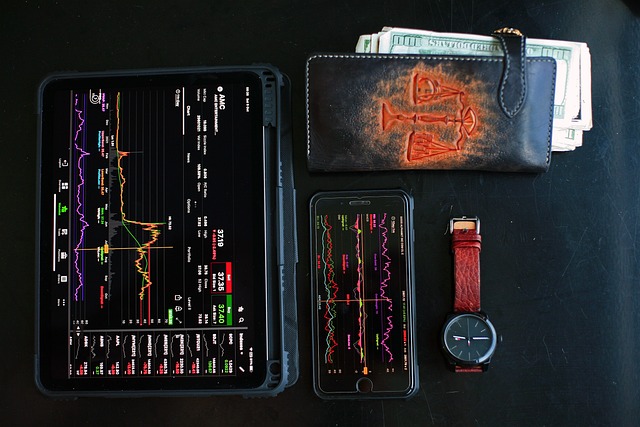

Cryptocurrency market indices offer a unified view of the digital asset landscape by tracking coin performance, facilitating informed decision-making and promoting transparency in today's integrated financial systems. Effective cryptocurrency wallet backup and recovery is paramount to safeguard digital assets from unforeseen events or attacks, requiring secure offline storage, encryption, and regular testing of recovery processes. While recovering lost funds in the decentralized blockchain environment poses unique challenges, advanced tools simplify and protect wallet management through secure backups, encryption, and recovery phrases.

“Dive into the dynamic world of cryptocurrency market indices and metrics, essential components for navigating this ever-evolving digital landscape. From understanding key market indices to deciphering crucial metrics, this comprehensive guide equips readers with insights for informed decision-making.

Explore best practices for securing your cryptocurrency through robust wallet backup and recovery strategies. Learn about common challenges and advanced tools that streamline wallet management, ensuring peace of mind in the volatile crypto market.”

- Understanding Cryptocurrency Market Indices: A Comprehensive Overview

- Key Metrics to Track in the Crypto Market

- The Importance of Regular Wallet Backup and Recovery

- Best Practices for Safeguarding Your Cryptocurrency

- Common Challenges in Recovering Lost Crypto Funds

- Advanced Tools for Efficient Wallet Management

Understanding Cryptocurrency Market Indices: A Comprehensive Overview

Cryptocurrency market indices are crucial tools for investors, analysts, and enthusiasts alike, offering a comprehensive view of the digital asset landscape. These indices track the performance of various cryptocurrencies over time, providing valuable insights into market trends and volatility. By aggregating data from numerous coins, they present a unified picture, making it easier to monitor and compare investments. The composition of these indices varies, with some focusing on popular coins like Bitcoin and Ethereum, while others embrace a more diverse approach, including lesser-known tokens. This diversity is essential for understanding the broader market health, especially when considering the dynamic nature of the cryptocurrency space.

In today’s digital era, where cryptocurrencies are becoming increasingly integrated into financial systems, having reliable metrics becomes paramount. Market indices serve as benchmarks, facilitating informed decision-making for investors who utilize them to assess risk and identify profitable opportunities. Furthermore, they play a vital role in promoting transparency and enabling easy comparison of different digital assets. For those managing cryptocurrency wallets and conducting regular backups and recovery processes, keeping an eye on these indices can be a strategic move to navigate the market efficiently.

Key Metrics to Track in the Crypto Market

In today’s dynamic cryptocurrency market, staying informed requires tracking key metrics that offer insights into the health and trends of digital assets. Among these, price movements are a foundational indicator, reflecting supply and demand forces at play. Volume traded provides further context, revealing investor sentiment and potential market manipulation.

Additionally, crucial metrics like market capitalization highlight the overall value and size of each cryptocurrency, while circulating supply gives an idea of scarcity or abundance. For proactive investors, considering factors like on-chain analytics—which delve into transaction patterns and network activity—can offer a competitive edge. Even crucial aspects like security and regulatory developments necessitate attention. A robust cryptocurrency wallet backup and recovery strategy complements this watchful approach, safeguarding digital assets against unforeseen events or malicious attacks.

The Importance of Regular Wallet Backup and Recovery

Best Practices for Safeguarding Your Cryptocurrency

Common Challenges in Recovering Lost Crypto Funds

Recovering lost cryptocurrency funds can be a challenging and complex process due to several factors unique to this digital asset class. One of the primary hurdles is the nature of blockchain technology, which provides a decentralized and transparent ledger but lacks central authorities or specific backup mechanisms. Unlike traditional banking systems with robust security measures and backup procedures, cryptocurrency wallets often rely on users to maintain their own backups. This responsibility falls squarely on the shoulders of individual investors, who must actively create and store secure copies of their private keys or wallet files.

Another common challenge is the lack of centralized recovery options. Unlike banks offering account recovery services, there’s no universal “reset password” feature for cryptocurrency wallets. In the event of a loss or theft, users typically have to resort to specific recovery methods tailored to their wallet type and the underlying blockchain network. This often involves intricate processes, such as accessing backups, reestablishing access through security measures like two-factor authentication, and employing specialized tools or community support forums for guidance. Effective cryptocurrency wallet backup and recovery strategies are essential to mitigate these challenges and ensure investors can safeguard their digital assets.

Advanced Tools for Efficient Wallet Management

The world of cryptocurrency offers a unique set of challenges for investors, one of the primary concerns being secure wallet management. To address this, advanced tools have emerged to streamline and safeguard digital asset storage. These innovative solutions provide users with efficient methods for backing up and recovering their cryptocurrency wallets, ensuring peace of mind in an otherwise volatile market.

With just a few clicks, users can now create secure backups of their private keys, often encrypted to prevent unauthorized access. This process is a game-changer for investors, as it allows them to quickly restore their wallets if ever they lose access to their devices. Additionally, these tools often include recovery phrases, which serve as a safety net in case of hardware failures or other unforeseen events. By embracing such technology, cryptocurrency enthusiasts can confidently navigate the market, knowing their digital assets are protected and easily retrievable.

The cryptocurrency market’s volatility necessitates a thorough understanding of indices and metrics to make informed decisions. By tracking key metrics and adopting best practices for securing your digital assets, including regular wallet backup and recovery strategies, investors can navigate this dynamic landscape with confidence. Advanced tools further enhance wallet management, mitigating risks and ensuring the safety of your hard-earned crypto funds, even in the face of common challenges. Remember, in the ever-evolving world of cryptocurrency, staying proactive with your wallet’s security is key to achieving long-term success.