Understanding altcoin volatility is crucial for successful ICO fundraising. Altcoins' prices are highly unpredictable due to market sentiment, regulatory news, and media coverage. To mitigate risks, investors should diversify across projects, set dynamic investment thresholds, stay informed, and adapt to market trends. Learning from case studies of past ICOs affected by volatility can provide valuable insights for better navigation in this dynamic landscape.

In the dynamic landscape of altcoin fundraising, understanding volatility is key to navigating successful ICOs. This article delves into the fundamental aspect of “Understanding Altcoin Volatility” and its interplay with market dynamics. We explore strategies to mitigate risk, balance rewards and risks through diversification, and adopt a long-term investment perspective where volatility can work in your favor. Learn from case studies and gain valuable insights into navigating the ever-changing world of initial coin offerings.

- Understanding Altcoin Volatility: A Fundamental Aspect of ICO Fundraising

- Factors Influencing Altcoin Price Fluctuations: Market Dynamics at Play

- Strategies to Mitigate Risk: Navigating Volatility for Successful ICOs

- Diversification and Portfolio Management: Balancing Risks and Rewards

- Long-term Investment Perspective: When Volatility Works in Your Favor

- Case Studies: Lessons Learned from ICOs Affected by Market Volatility

Understanding Altcoin Volatility: A Fundamental Aspect of ICO Fundraising

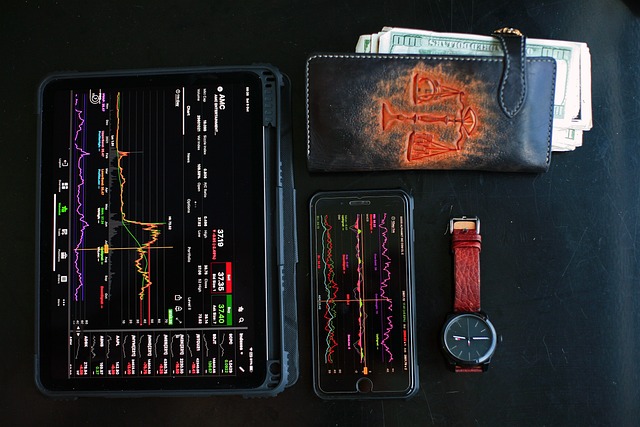

Understanding altcoin volatility is a fundamental aspect of ICO fundraising. Altcoins, being decentralized digital currencies built on blockchain technology, are subject to significant price fluctuations due to various market factors, including speculation, regulatory uncertainty, and community sentiment. This inherent volatility can present both challenges and opportunities for initial coin offerings (ICOs).

For ICO fundraisers, understanding altcoin volatility is crucial in setting realistic funding goals and managing investor expectations. While sharp price swings can create risks, they also offer potential for significant gains. Therefore, a robust risk management strategy that accounts for market dynamics is essential to navigate this landscape successfully and ensure the long-term viability of the project.

Factors Influencing Altcoin Price Fluctuations: Market Dynamics at Play

Altcoin prices are highly volatile due to a complex interplay of market dynamics. One significant factor is the overall health and sentiment of the cryptocurrency market. Since altcoins often derive their value from their association with Bitcoin or other leading cryptocurrencies, broader market trends can dramatically impact their prices.

Another crucial element is regulatory developments and news. Changes in government regulations regarding initial coin offerings (ICOs) or cryptocurrency trading can cause sharp price fluctuations. Additionally, media coverage and social sentiment play a significant role. Positive news and widespread adoption can drive up prices, while negative publicity or skepticism can lead to rapid drops. The decentralized nature of cryptocurrencies also contributes to their volatility, as there are no central authorities to stabilize the market.

Strategies to Mitigate Risk: Navigating Volatility for Successful ICOs

Understanding altcoin volatility is paramount for successful ICO fundraising. One key strategy involves diversifying investment portfolios to mitigate risk. By spreading investments across multiple projects, investors can protect themselves from significant losses if one coin experiences a sharp decline. Additionally, setting clear investment thresholds and adhering to a disciplined allocation plan can help navigate market fluctuations.

Another effective approach is implementing dynamic pricing mechanisms that adjust in real-time based on market conditions. This allows for the capture of opportunities during periods of volatility, while also safeguarding against substantial drops. Moreover, staying informed about industry trends, regulatory changes, and technological advancements enables investors to make more informed decisions, thereby enhancing their chances of navigating altcoin volatility successfully.

Diversification and Portfolio Management: Balancing Risks and Rewards

In the dynamic landscape of ICO fundraising, understanding altcoin volatility is paramount for investors aiming to balance risks and rewards. Diversification plays a pivotal role in managing portfolio exposure; by allocating funds across multiple projects with varying risk profiles, investors can mitigate potential losses from any single investment’s fluctuations. This strategic approach ensures that even if one altcoin experiences sharp drops, others may stabilize or rise, preserving overall portfolio value.

Effective portfolio management involves continuous monitoring and rebalancing. Investors should stay abreast of market trends, project developments, and community sentiment to make informed decisions about when to add or subtract investments. By adopting a disciplined approach, they can navigate the unpredictable nature of altcoins, capitalizing on growth opportunities while safeguarding their capital from excessive volatility.

Long-term Investment Perspective: When Volatility Works in Your Favor

Investing in ICOs (Initial Coin Offerings) offers a unique perspective on understanding altcoin volatility. While the market’s inherent fluctuations can be intimidating for short-term investors, they present an opportunity for long-term visionaries. Embracing volatility allows investors to capitalize on potential price corrections and market rebounds.

By adopting a long-term investment strategy, individuals can navigate the ups and downs of the cryptocurrency market with greater agility. This approach enables them to resist impulsive decisions driven by short-term instability and instead focus on the fundamental growth prospects of altcoins. Understanding how volatility can work in their favor requires patience, thorough research, and a commitment to staying informed about industry trends and developments.

Case Studies: Lessons Learned from ICOs Affected by Market Volatility

In the ever-evolving landscape of cryptocurrency, Initial Coin Offerings (ICOs) have emerged as a prominent fundraising strategy for blockchain projects. However, understanding altcoin volatility is crucial when navigating this space. Case studies from ICOs affected by market fluctuations offer valuable lessons for investors and project creators alike. For instance, the infamous DAO (Decentralized Autonomous Organization) project, which aimed to decentralize decision-making within a community-owned fund, saw its ICO hit with sudden price drops due to regulatory concerns. This event highlighted the importance of robust risk management strategies, as well as transparent communication with investors about potential market risks.

Another notable example is the collapse in value of certain tokens during high-profile ICOs, which led to significant losses for early backers. These incidents underscore the need for thorough due diligence on the part of investors and careful consideration of project fundamentals, such as team experience, roadmap clarity, and community support. By learning from these cases, both developers and investors can better prepare for navigating the unpredictable waters of altcoin volatility during ICO fundraising.

Understanding altcoin volatility is key to navigating the complexities of ICO fundraising. By recognizing factors influencing price fluctuations and employing strategies to mitigate risk, project leaders can balance rewards with responsibilities. Diversification, long-term investment perspectives, and learning from case studies empower stakeholders to make informed decisions in this dynamic landscape. Remember that navigating volatility is not just about risk but also presenting opportunities for successful ICOs.