The cryptocurrency market's extreme volatility poses significant risks for long-term holders due to factors like regulatory changes, media coverage, market sentiment, and tech advancements. A comprehensive Crypto tax reporting guide is essential for navigating these challenges. Accurate record-keeping and timely reporting protect investors from legal issues, ensure compliance with evolving regulations, and safeguard portfolios from volatility's impact. By utilizing such a guide, investors can monitor portfolio performance, make informed decisions, and implement strategies like diversification and stop-loss orders to mitigate risks, ensuring a more secure investment journey.

In the dynamic realm of cryptocurrencies, market volatility poses significant risks. This article serves as a comprehensive guide to navigating the uncertainties inherent in digital asset investments. We’ll explore the factors driving crypto market fluctuations and delve into effective risk management strategies. Furthermore, we’ll examine the critical role of crypto tax reporting in mitigating potential losses and offer best practices for thriving amidst market shifts. Understanding these aspects is essential for investors aiming to secure their crypto assets.

- Understanding Cryptocurrency Market Volatility

- Risks Associated with Crypto Investments

- Strategies for Effective Risk Management

- The Role of Crypto Tax Reporting in Risk Mitigation

- Best Practices for Navigating Market Fluctuations

Understanding Cryptocurrency Market Volatility

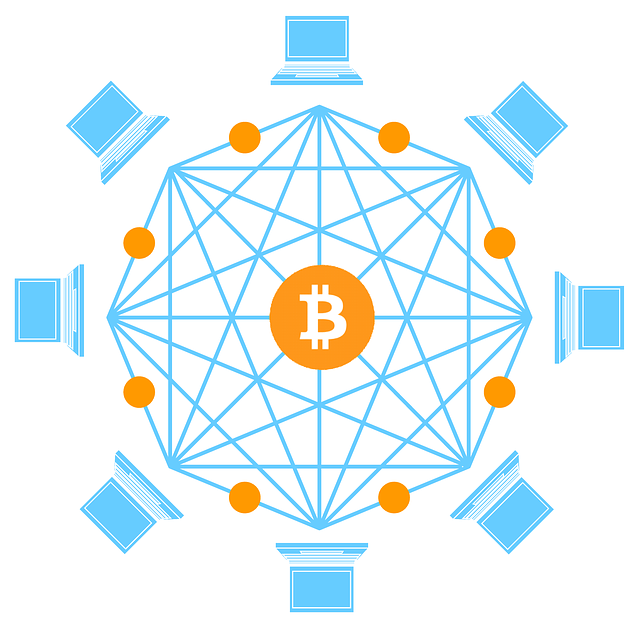

The cryptocurrency market is known for its extreme volatility, with prices fluctuating dramatically over short periods. This unpredictability poses significant risks to investors, especially those who hold crypto assets for the long term. Understanding this volatile landscape is a crucial step in managing risk effectively. The price swings are often driven by various factors, including regulatory changes, media coverage, market sentiment, and technological advancements.

A comprehensive Crypto tax reporting guide becomes essential when navigating these turbulent waters. Accurate record-keeping and timely reporting of crypto transactions can help investors mitigate potential legal issues and ensure they remain compliant with ever-evolving regulations. By staying informed about market dynamics and employing strategic tax management practices, investors can better protect their portfolios and reduce the impact of volatility on their financial goals.

Risks Associated with Crypto Investments

Investing in cryptocurrencies comes with unique risks that differ from traditional markets. Volatility is perhaps the most well-known danger, as crypto prices can fluctuate dramatically in short periods. This makes it challenging for investors to time their trades accurately and can lead to substantial gains or losses. Additionally, the decentralized nature of cryptocurrencies means that there’s often limited regulatory oversight, which can make them vulnerable to market manipulation and fraud.

Another critical aspect to consider is tax liability. As cryptocurrency gains traction, governments worldwide are developing regulations to capture taxes on crypto transactions. This presents a complex challenge for investors, as reporting crypto-related income accurately and adhering to evolving tax guidelines can be intricate. A comprehensive Crypto tax reporting guide becomes essential for navigating these uncharted waters, ensuring compliance, and managing potential tax risks effectively.

Strategies for Effective Risk Management

Volatility in the cryptocurrency market presents significant risks for investors, but effective risk management strategies can help mitigate these challenges. A crucial step is understanding and tracking your crypto portfolio’s performance using reliable tools and a comprehensive crypto tax reporting guide. This allows you to identify trends, set benchmarks, and make informed decisions. Diversification is another powerful strategy; spreading investments across various cryptocurrencies can reduce the impact of price swings.

Additionally, setting stop-loss orders is an essential risk management tool. These orders automatically trigger the sale of assets when they reach a specific price, limiting potential losses. Regularly reviewing and adjusting your investment strategy based on market trends, news, and regulatory changes is vital for navigating the volatile crypto market.

The Role of Crypto Tax Reporting in Risk Mitigation

In the volatile world of cryptocurrencies, effective risk management is paramount for investors aiming to navigate this dynamic market with confidence. One often-overlooked yet powerful tool in their arsenal is crypto tax reporting. As the cryptocurrency space continues to evolve, so do the regulatory requirements, emphasizing the need for a comprehensive crypto tax reporting guide. Accurate and timely tax reporting serves as a safeguard against potential legal issues and financial losses.

By adhering to a robust crypto tax reporting process, investors can better track their transactions, calculate gains or losses, and ensure compliance with tax authorities. This practice enables proactive risk mitigation by identifying areas of potential exposure, such as unrealized profits or tax-related penalties. Moreover, it fosters transparency and helps individuals make informed decisions regarding their cryptocurrency investments, ultimately contributing to a more secure and sustainable investment journey.

Best Practices for Navigating Market Fluctuations

Navigating market fluctuations in the cryptocurrency space requires a strategic approach. One of the best practices for investors is to adopt a long-term perspective, as short-term volatility can be misleading. Instead of making impulsive decisions based on daily price swings, consider setting clear investment goals and diversifying your portfolio across various cryptocurrencies. This reduces risk by spreading exposure and minimizing the impact of any single asset’s instability.

A crucial aspect often overlooked is effective crypto tax reporting guide management. Volatility can significantly affect tax liabilities due to frequent trades. Implement a robust tracking system to record all transactions, including purchase dates, prices, and quantities. Regularly review and update these records to ensure accurate cost basis calculations, which are essential for determining capital gains or losses when selling cryptocurrencies. This proactive approach not only simplifies tax reporting but also helps investors make informed decisions in volatile markets.

Volatility is an inherent characteristic of the cryptocurrency market, but effective risk management strategies can help mitigate potential losses. By understanding the risks associated with crypto investments and adopting best practices for navigating market fluctuations, investors can make more informed decisions. Additionally, crypto tax reporting plays a crucial role in risk mitigation by providing transparency and accountability. This comprehensive guide equips individuals with the knowledge to safely navigate the cryptocurrency landscape.