Emotions heavily impact crypto trading, especially in volatile markets. Traders using advanced features on crypto platforms may feel pressured to react impulsively to price changes. For successful long-term trading, mental discipline is key, involving setting goals, defining risk parameters, and sticking to strategies despite market allure. Advanced tools like stop-loss orders and position sizing calculators help manage impulsive decisions driven by fear or greed. Mental resilience equips traders to handle volatility, distinguish short-term fluctuations from trends, and make data-driven choices based on fundamental analysis. Crypto platforms with advanced features offer sophisticated indicators, machine learning algorithms, social trading components, and backtesting capabilities that enhance decision-making and preparation in the dynamic crypto market. Building a solid strategy, utilizing these tools, and maintaining discipline are crucial for rational and profitable crypto trading.

In the fast-paced world of crypto trading, mastering one’s psychology is as crucial as understanding market trends. This article explores the intricate relationship between emotion and decision-making in crypto, offering insights on how traders can develop a disciplined mindset to thrive in volatile markets. We delve into the importance of mental resilience, advanced features on top-tier crypto platforms for informed choices, and robust strategies for adaptability, ensuring success in this dynamic landscape.

- Understanding the Impact of Emotion on Crypto Trading

- Developing a Disciplined Trading Mindset

- The Role of Mental Resilience in Volatile Markets

- Advanced Features on Crypto Platforms for Enhanced Decision-Making

- Building a Robust Trading Strategy for Success

- Maintaining Focus and Adaptability in Rapidly Changing Crypto Landscapes

Understanding the Impact of Emotion on Crypto Trading

Emotions play a significant role in crypto trading, often impacting decision-making processes. Cryptocurrency markets are known for their volatility, which can trigger strong emotional responses like fear or greed. Traders using advanced features on crypto platforms might feel pressured to capitalize on rapid price fluctuations, leading to impulsive trades based on panic or excitement.

Understanding and managing these emotions is crucial for successful long-term trading. By acknowledging the influence of emotion, traders can develop strategies to maintain composure during market swings. This mental preparation involves setting clear goals, defining risk parameters, and adhering to a disciplined approach, even when faced with the allure of quick gains or the fear of missing out on potential profits.

Developing a Disciplined Trading Mindset

In the dynamic world of crypto trading, developing a disciplined mindset is as crucial as mastering the technical aspects. Traders often face the unique challenge of managing their emotions amidst market volatility and rapid price fluctuations. Building mental resilience is essential to navigating this high-stakes landscape. By adopting a structured approach, traders can cultivate discipline that goes beyond simply following a set of rules; it involves recognizing and controlling impulsive decisions driven by fear or greed.

Using advanced features on crypto platforms can aid in this process. Tools designed for risk management, such as stop-loss orders and position sizing calculators, empower traders to stick to their trading plans. These features not only help maintain emotional detachment but also ensure that each trade is executed with a clear strategy, fostering a more disciplined and consistent approach.

The Role of Mental Resilience in Volatile Markets

In the high-stakes world of crypto trading, where markets can experience sudden and severe volatility, mental resilience is a crucial asset for investors. This adaptability isn’t just about enduring stress; it’s about embracing the inherent unpredictability of the market while maintaining composure under pressure. Traders who possess this psychological fortitude are better equipped to navigate the turbulent waters of crypto platforms with advanced features, where rapid price swings can trigger impulsive decisions.

Mental resilience allows traders to separate short-term fluctuations from long-term trends, enabling them to stick to their strategies even when faced with temporary setbacks or market chaos. It fosters discipline, self-awareness, and emotional control—essential traits for successful crypto trading. By cultivating mental resilience, investors can make informed decisions based on fundamental analysis rather than impulsive reactions, ultimately contributing to more robust and consistent performance in volatile markets.

Advanced Features on Crypto Platforms for Enhanced Decision-Making

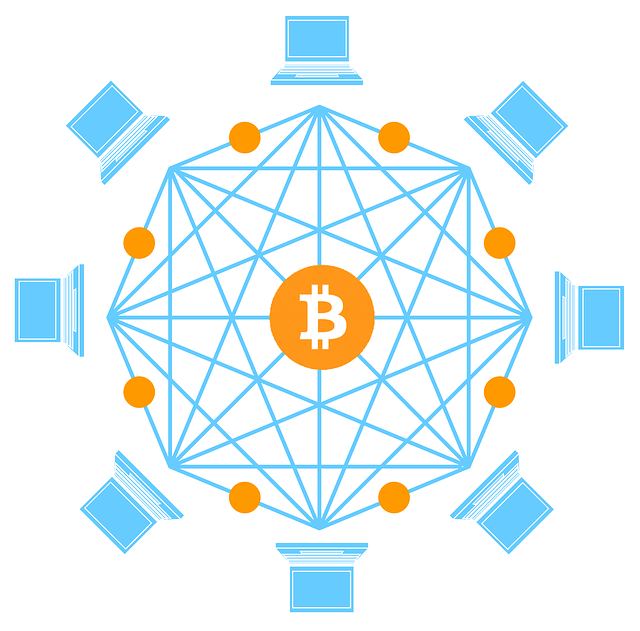

In the fast-paced and often volatile world of cryptocurrency trading, having access to advanced features on crypto platforms can make all the difference in decision-making. These tools are designed to provide traders with a competitive edge by offering insights and analyses that go beyond basic price charts. Advanced indicators, for instance, allow users to identify trends and patterns more accurately, helping them enter or exit trades at optimal times. Machine learning algorithms integrated into these platforms can predict market movements based on historical data, providing valuable predictive analytics.

Moreover, crypto platforms with advanced features often include social trading components, enabling users to learn from the strategies of successful traders. This peer-to-peer knowledge sharing fosters a more informed and confident trading environment. Additionally, backtesting capabilities allow traders to simulate trades in historical markets, refining their strategies before risking real capital. Such advanced functionalities contribute significantly to enhanced decision-making, mental preparation, and overall success in navigating the dynamic landscape of cryptocurrency trading.

Building a Robust Trading Strategy for Success

Building a robust trading strategy is paramount in navigating the volatile crypto market, where emotional decision-making can often lead to significant losses. A well-crafted plan that incorporates technical analysis and risk management techniques is essential for success. Crypto platforms with advanced features, such as sophisticated charting tools, order types, and automated trading options, can empower traders by providing insights into market trends and executing trades efficiently.

By combining these platform advantages with a disciplined approach, traders can create a structured strategy. This involves identifying entry and exit points based on technical indicators, setting clear risk parameters to protect capital, and sticking to the plan regardless of short-term price fluctuations. Such mental preparation ensures that emotions don’t cloud judgment, leading to more calculated and successful crypto trading experiences.

Maintaining Focus and Adaptability in Rapidly Changing Crypto Landscapes

In the dynamic and ever-evolving world of cryptocurrency, maintaining focus and adaptability is paramount for traders navigating these volatile markets. The rapid pace at which prices fluctuate and trends shift demands a mental resilience and sharp cognitive abilities. Traders must continuously monitor market shifts, digesting vast amounts of data from various crypto platforms with advanced features to make informed decisions in real-time. This requires an ability to filter out noise and distractions, focusing on key indicators and price movements that signal potential opportunities or risks.

Adaptability is crucial as the crypto landscape can change dramatically within minutes. Traders need to be agile, adjusting their strategies and risk management techniques swiftly in response to market dynamics. Developing a disciplined approach to trading, including setting clear entry and exit points, managing position sizes, and adhering to a well-defined risk framework, helps maintain focus during turbulent times. This mental preparation allows traders to stay calm under pressure, make rational decisions, and ultimately, capitalize on the opportunities presented by these dynamic crypto markets.

In the volatile world of crypto trading, mastering one’s psychology is as crucial as understanding market dynamics. By adopting a disciplined mindset, fostering mental resilience, and leveraging advanced features on crypto platforms, traders can navigate the rapid changes in the landscape effectively. A robust trading strategy that maintains focus and adaptability is key to success. Remember, emotional intelligence is just as important as technical skills, enabling you to make rational decisions and capitalize on opportunities in this dynamic market.