Litecoin mining is a crucial component of the Litecoin network's security, involving powerful computers solving complex equations to verify transactions and create new coins. Beginners must understand key concepts like tracking cryptocurrency market sentiment indicators to gauge profitability, as these indicators heavily influence mining costs versus returns. Positive sentiment, driven by optimistic news or technological advancements, boosts Litecoin's price and profitability. Miners should also monitor network difficulty levels due to price volatility and limited supply, as well as stay abreast of industry trends and key market metrics to maximize return on investment (ROI) in the volatile cryptocurrency landscape. Optimizing hardware, software, and mining techniques is essential for success.

“Uncover the ins and outs of Litecoin mining profitability—a comprehensive guide tailored for both novice and experienced miners. We’ll first demystify Litecoin mining, exploring its place in the dynamic cryptocurrency market and crucial sentiment analysis indicators. Then, we’ll delve into key profitability factors, comparing Litecoin to other cryptocurrencies. From hardware and software choices to energy costs, this article equips you with insights. Discover strategies to optimize returns in today’s ever-changing cryptocurrency landscape.”

- Understanding Litecoin Mining: A Beginner's Guide

- The Cryptocurrency Market: Trends and Sentiment Analysis

- Profitability Factors: How Litecoin Mining Compares

- Technical Aspects: Hardware, Software, and Energy Costs

- Strategies for Maximizing Litecoin Mining Returns

Understanding Litecoin Mining: A Beginner's Guide

Litecoin mining, like other cryptocurrencies, involves a process where powerful computers solve complex mathematical equations to verify transactions and create new coins. It’s a crucial component of the Litecoin network, ensuring its security and decentralization. For beginners, understanding Litecoin mining profitability requires grasping several key concepts.

First, it’s essential to track the cryptocurrency market sentiment indicators, as they can significantly impact mining costs versus potential returns. Litecoin’s price volatility, along with its limited supply, makes it an attractive option for investors and miners alike. However, staying informed about network difficulty levels is paramount; mining becomes more competitive as more miners join the network, affecting overall profitability.

The Cryptocurrency Market: Trends and Sentiment Analysis

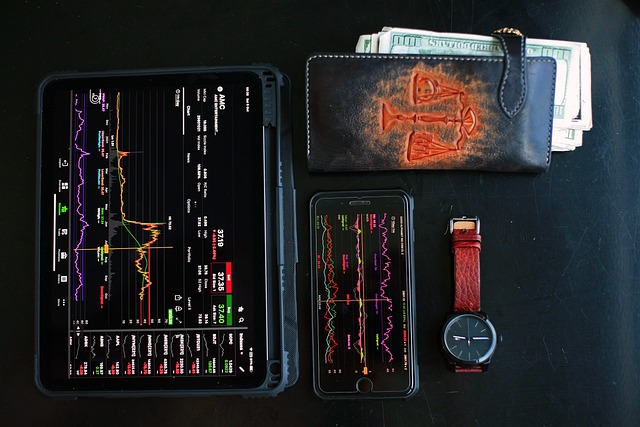

The cryptocurrency market, a dynamic and ever-evolving space, is heavily influenced by market sentiment—the collective attitude and emotions of investors. This sentiment plays a crucial role in determining the price movements of digital assets like Litecoin. Sentiment analysis, using various indicators such as social media buzz, news headlines, and trading volume, offers valuable insights into the overall market trends.

Traders and analysts closely monitor these sentiment indicators to gauge investor confidence. Positive sentiment, often fueled by optimistic news or technological advancements, can drive up demand for Litecoin, potentially increasing its profitability. Conversely, negative sentiment, stemming from regulatory concerns or market volatility, might lead to a decline in mining profitability as investors become more cautious. Understanding the cryptocurrency market sentiment is essential for miners to make informed decisions regarding their operations and future strategies.

Profitability Factors: How Litecoin Mining Compares

Litecoin mining, like any other cryptocurrency mining operation, is heavily influenced by profitability factors that can shift rapidly in response to various market dynamics. While Bitcoin often dominates discussions around digital currencies, Litecoin offers a distinct set of advantages and challenges for miners. One key aspect to consider is the block reward structure; Litecoin blocks are mined at a faster rate than Bitcoin, providing a higher per-minute profit potential.

The cryptocurrency market sentiment indicators play a crucial role in Litecoin mining profitability as well. Positive market sentiment towards Litecoin can drive up its price, making it more attractive for miners. Conversely, negative sentiment or increased competition from other cryptocurrencies can lead to decreased mining rewards. Staying informed about industry trends and keeping an eye on key market sentiment metrics is vital for miners looking to maximize their Litecoin mining ROI.

Technical Aspects: Hardware, Software, and Energy Costs

Litecoin mining, like any cryptocurrency mining operation, involves a combination of technical aspects that significantly impact profitability. On the hardware front, miners need access to Application-Specific Integrated Circuits (ASICs) specifically designed for Litecoin. These devices are crucial in efficiently solving complex mathematical problems required to validate transactions and create new blocks on the blockchain. The choice of ASICs can vary based on factors like hash rate, power consumption, and cost—all essential considerations in balancing profitability with operational costs.

Software-wise, miners must utilize compatible mining software that communicates with their hardware to optimize performance. Popular options include tools like GetBlockTemplate (GBT) and CUDA for NVIDIA GPUs. Additionally, monitoring software is vital to track mining progress, energy usage, and costs. Energy costs are another critical component; a stable and affordable power source is indispensable for miners. With the cryptocurrency market sentiment indicators fluctuating, miners must also consider the potential impact on electricity rates and network competition, as these can influence overall profitability.

Strategies for Maximizing Litecoin Mining Returns

To maximize Litecoin mining returns, miners should stay attuned to the cryptocurrency market sentiment indicators. Keeping a close eye on price fluctuations and trading volume can provide valuable insights into network activity and future trends. During periods of positive market sentiment and high trading volumes, the profitability of mining Litecoin is typically enhanced due to higher block reward rates and increased network demand.

Additionally, miners should consider optimizing their hardware and software configurations. Using efficient mining rigs and up-to-date mining software can significantly improve mining speeds and energy efficiency, directly translating to higher returns. Staying informed about the latest mining techniques and best practices is also crucial for maximizing Litecoin mining profitability in a competitive market.

Litecoin mining, though once a lucrative venture, faces evolving challenges within the dynamic cryptocurrency market. Understanding market sentiment through key indicators is crucial for gauging profitability. While technical aspects like hardware and energy costs remain essential considerations, adopting effective strategies can help maximize returns. Staying informed about market trends and analyzing sentiment indicators will enable Litecoin miners to make data-driven decisions in this ever-changing landscape.