Cryptocurrency mining pools have emerged as a collaborative solution for miners, combining computational power to increase their chances of solving complex mathematical problems and earning rewards in an increasingly competitive landscape. Institutional crypto strategies leverage these pools to maximize efficiency and profitability by accessing advanced hardware, algorithms, and data centers, securing a competitive edge. Success in the pool depends on factors like market conditions, coin prices, network difficulties, hardware efficiency, and strategic adaptations based on performance metrics. Institutional investors are drawn to mining pools for their high return potential and diversification benefits, employing data analytics to select profitable pools with robust security measures. Successful pools maintain their edge through centralized operations, advanced technology adoption, smart contracts, and portfolio diversification.

In the dynamic realm of cryptocurrency, mining pool profitability is a topic of immense interest. This article explores the intricate world of cryptocurrency mining pools, offering a comprehensive guide for both beginners and institutions. We’ll first dissect the fundamentals, then delve into the key factors shaping profitability. Next, discover institutional crypto strategies for optimal participation, followed by insightful case studies from top mining pools. Uncover valuable insights and lessons that can propel your journey in this revolutionary space.

- Understanding Cryptocurrency Mining Pools: A Basic Overview

- Factors Affecting Mining Pool Profitability: A Deep Dive

- Institutional Strategies for Optimal Crypto Mining Pool Participation

- Case Studies: Success Stories and Lessons Learned from Top Mining Pools

Understanding Cryptocurrency Mining Pools: A Basic Overview

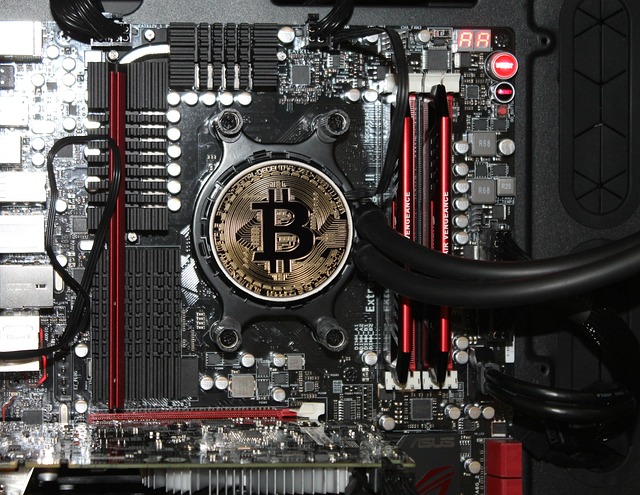

Cryptocurrency mining pools have emerged as a collaborative approach for miners to increase their chances of solving complex mathematical problems and earning cryptocurrency rewards. In simple terms, these pools allow individual miners to combine their computational power and resources, enhancing their collective ability to mine blocks and validate transactions within a specific blockchain network. This concept is particularly significant in the dynamic world of crypto, where the increasing complexity of mining requires substantial computational might.

Institutional crypto strategies often incorporate mining pools as a means to maximize efficiency and profitability. By joining forces, these institutional players can access more powerful hardware, advanced algorithms, and larger data centers, thereby securing a competitive edge in the mining process. This collaborative model not only enhances the pool’s overall success rate but also distributes the risks associated with volatile cryptocurrency markets.

Factors Affecting Mining Pool Profitability: A Deep Dive

The profitability of cryptocurrency mining pools is influenced by a multitude of factors, reflecting the dynamic nature of both the crypto market and the underlying technology. One key aspect is institutional crypto strategies: large-scale investors often play a significant role in shaping pool dynamics through their purchasing power and strategic partnerships. These institutions can drive up network hashrate, potentially increasing competition and reducing individual pool profitability for smaller miners.

Additionally, the choice of cryptocurrency being mined matters greatly; different coins have varying difficulty levels and block reward structures. Pool operators must continually monitor market conditions and adapt to changes in coin prices and network difficulties. Other factors include the efficiency of mining hardware, power costs, and the talent and infrastructure behind managing a successful pool. These interconnected elements require miners and pool administrators to stay agile and informed in this rapidly evolving landscape.

Institutional Strategies for Optimal Crypto Mining Pool Participation

Institutional investors are increasingly turning their attention to cryptocurrency mining pools as a strategic asset class, driven by the potential for high returns and the desire for diversification. These institutions often employ sophisticated crypto strategies, such as long-term investment approaches, leveraging data analytics to identify profitable mining pools with strong security protocols. By pooling resources and expertise, they gain access to larger networks, enhancing their mining efficiency and profitability.

Effective institutional crypto strategies in mining pools involve careful selection based on market trends, regulatory environments, and the pool’s technological infrastructure. They may also include dynamic participation, where institutions adjust their investments based on performance metrics, ensuring a balanced portfolio that captures both short-term gains and long-term stability within the volatile cryptocurrency market.

Case Studies: Success Stories and Lessons Learned from Top Mining Pools

The world of cryptocurrency mining pools has witnessed its fair share of successes and failures, offering valuable insights for both new and established players. Case studies of top mining pools provide a glimpse into effective institutional crypto strategies that have led to significant profitability. These success stories often revolve around efficient resource allocation, leveraging advanced technologies, and adopting innovative business models. For instance, some leading pools have achieved remarkable success by centralizing operations, enabling them to negotiate better terms with hardware manufacturers and reduce overall costs.

Lessons learned from these top performers highlight the importance of staying adaptable in a rapidly evolving market. Many successful mining pools have consistently adjusted their strategies based on market trends, regulatory changes, and technological advancements. They have embraced decentralized technologies, implemented smart contracts for transparent operations, and diversified their portfolios to include various cryptocurrencies. These strategies have allowed them to maintain a competitive edge, ensuring profitability even amidst intense competition.

Cryptocurrency mining pool profitability is a complex interplay of technological advancements, market dynamics, and strategic institutional investments. By understanding the fundamental concepts of mining pools and delving into key profitability factors, organizations can navigate the competitive landscape effectively. Adopting tailored institutional crypto strategies and learning from successful case studies empowers entities to maximize their participation in these pools, ensuring sustained growth in the ever-evolving digital currency ecosystem.