The halving process in Bitcoin's protocol, occurring approximately every four years, significantly influences its price dynamics by reducing miner rewards and adjusting supply. Historically, these events have sparked price increases due to reduced supply and increasing demand, reflecting broader market sentiment, adoption trends, and regulatory environments. Investors view halving as a potential price appreciation signal, leading to increased investment and speculation. As Bitcoin gains institutional acceptance, its price movements become intertwined with global economic conditions and investor confidence. The upcoming halving events continue to spark curiosity and debate, with historical data showing price surges post-halving, underscoring Bitcoin's potential as a long-term digital asset investment.

“Dive into the intriguing world of default and its profound impact on Bitcoin, the pioneering cryptocurrency. This comprehensive article unravels the complex interplay between default events and Bitcoin’s market dynamics. From understanding the foundational concepts to exploring historical perspectives, we delve into how defaults shape Bitcoin’s price movements. Furthermore, we analyze recent trends, particularly the halving event, and gaze into the future, predicting potential implications for Bitcoin’s value trajectory in light of these pivotal occurrences.”

- Understanding Bitcoin's Price Dynamics

- The Concept of Default in Crypto

- Historical Perspective: Default Events and Their Effects on Bitcoin

- How Default Impacts Bitcoin's Market

- Recent Trends: Halving and Its Role

- Exploring the Future: Predictions and Implications

Understanding Bitcoin's Price Dynamics

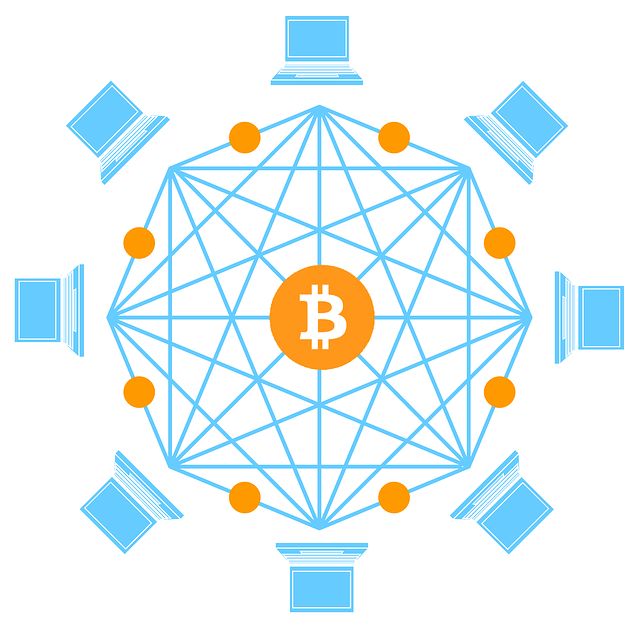

Bitcoin, as a decentralized digital currency, experiences price dynamics influenced by various factors. One significant event that has captured the attention of investors and enthusiasts alike is the halving process. This mechanism, built into Bitcoin’s protocol, reduces the block reward for miners by half approximately every 210,000 blocks or roughly every four years. The impact of halving on Bitcoin’s price is a topic of much interest. Historically, halving events have led to notable price increases due to reduced supply and heightened demand. As mining becomes more challenging and costly, the scarcity of new bitcoins enters the market, potentially driving up their value.

The halving impact on Bitcoin price is not solely driven by supply-side factors; it also resonates with broader market sentiment, adoption trends, and regulatory environments. Investors often view halving as a signal for potential price appreciation, fostering increased investment and speculation. Moreover, as Bitcoin gains institutional acceptance and enters the financial mainstream, its price movements become increasingly intertwined with global economic conditions and investor confidence.

The Concept of Default in Crypto

In the cryptocurrency realm, the concept of “default” takes on a unique and intriguing dimension compared to traditional financial systems. It refers to a pre-determined setting or outcome that automatically triggers when certain conditions are met, particularly in blockchain networks. One notable example is the halving event, which significantly impacts Bitcoin’s price dynamics. Halving, or reducing the block reward for miners by half, occurs approximately every four years and has been observed to create a temporary yet substantial price surge for Bitcoin. This event not only alters the cost of mining but also adjusts the overall supply of new bitcoins entering circulation, potentially driving up demand and causing price fluctuations.

The crypto market’s sensitivity to halving events underscores the importance of understanding default mechanisms in this emerging digital economy. As these events impact the fundamental economic factors of supply and demand, they serve as a reminder of the intricate interplay between technology, economics, and investor psychology. With the decentralized nature of cryptocurrencies, defaults are not merely technical glitches but strategic elements that shape the long-term trajectory of projects like Bitcoin.

Historical Perspective: Default Events and Their Effects on Bitcoin

In the early days of Bitcoin, default events played a pivotal role in shaping its trajectory and public perception. One of the most notable examples is the halving process, where the number of new bitcoins created every block is reduced by half. This event, which occurs approximately every four years, has significantly impacted Bitcoin’s price and market stability. Each halving acts as a signal to investors and enthusiasts, often sparking curiosity and driving interest in the cryptocurrency.

Historically, Bitcoin’s price has shown notable surges following halvings, reflecting a growing adoption and increased institutional interest. The halving impact on Bitcoin price has been observed to create a sense of anticipation and scarcity, leading to higher demand. This historical perspective highlights how default events can serve as pivotal catalysts for Bitcoin’s evolution, influencing not just its economic value but also its role in the global financial landscape.

How Default Impacts Bitcoin's Market

Bitcoin, like any other cryptocurrency, is subject to various factors that influence its market dynamics. One significant event that has a profound impact on its price is the Halving process. This occurs roughly every four years and involves reducing the block reward for miners by half. The halving impact on Bitcoin’s price is notable; it often triggers a period of volatility and speculation. Investors anticipate the event, leading to potential price surges or drops as supply and demand shift.

The halving event can cause a temporary decrease in Bitcoin’s circulation as mining becomes less lucrative, potentially reducing the number of new coins entering the market. This can create a scarcity effect, similar to limited-edition items, driving up prices over time. Moreover, historical data suggests that following halvings, Bitcoin’s price often experiences upward momentum, attracting more investors and increasing its market reach.

Recent Trends: Halving and Its Role

In recent years, one of the most significant trends shaping the cryptocurrency market is halving—a process unique to Bitcoin. Halving, or reducing the block reward for mining by half, occurs approximately every four years and has been a key factor in Bitcoin’s price appreciation. The impact of halving on Bitcoin’s value cannot be overstated; it creates a supply scarcity that aligns with increasing demand, driving up prices.

The most notable effect is observed during the period leading up to the event, as miners race to secure blocks before the reward is cut in half. This heightened activity often intensifies price volatility and draws substantial media attention. After halving, Bitcoin’s price has historically shown resilience and a tendency to appreciate further, solidifying its position as a digital asset with potential long-term growth.

Exploring the Future: Predictions and Implications

As we peer into the future, the potential implications of halving events for cryptocurrencies like Bitcoin are a subject of much fascination and speculation among experts. The concept of halving, or reducing the block reward for miners by half, is not unique to Bitcoin; it’s a predefined mechanism designed to control inflation and limit the supply of new coins. Historically, these events have had a notable impact on Bitcoin’s price dynamics. However, with each subsequent halving, the effect seems to diminish slightly. The upcoming halvings will likely continue this trend, potentially leading to a situation where market reactions become increasingly predictable for investors.

This evolution raises intriguing questions about the long-term stability and growth of cryptocurrencies. While halving may mitigate inflationary pressures in the short term, it also introduces uncertainty regarding future price movements. Some analysts predict that Bitcoin’s halving events will continue to drive its scarcity and desirability, leading to sustained or even increased price appreciation. Conversely, others argue that as the block rewards decrease, the profitability of mining will wane, potentially reducing the network’s overall security and creating new challenges for miners. Ultimately, navigating these future scenarios requires careful analysis of market trends, technological advancements, and regulatory landscapes.

Bitcoin’s resilience against default events, as demonstrated throughout history, is remarkable. The cryptocurrency market, though volatile, has shown that halving events, like those related to Bitcoin’s supply reduction, significantly influence its price dynamics. As we look towards the future, understanding how halving impacts Bitcoin’s value could prove crucial for investors navigating this evolving digital asset landscape.