Ethereum's blockchain technology has transformed crypto investments and democratic processes with its smart contracts enabling secure peer-to-peer transactions and transparent voting. As crypto markets become more volatile during elections, understanding Ethereum is key for navigating this dynamic space. This guide focuses on developing decentralized applications (dApps) using Solidity and the Ethereum Virtual Machine (EVM), catering to both developers and investors. It offers insights into creating profitable and secure election-focused dApps while highlighting crucial aspects of crypto investment during elections, considering candidates' stances and global economic trends.

In the dynamic landscape of cryptocurrency, Ethereum stands as a blockchain game-changer. This article explores its pivotal role in shaping crypto investments, especially during elections. We delve into the intricate workings of the Ethereum blockchain and its impact on market dynamics. Understanding these factors is crucial for investors seeking opportunities amidst election-driven volatility. Additionally, we provide a comprehensive guide to developing Ethereum applications, offering insights that can capitalize on the evolving crypto market’s potential during political events.

- Understanding Ethereum Blockchain and Its Role in Crypto Investments

- The Impact of Elections on Crypto Markets: Opportunities and Risks

- Developing Ethereum Applications: A Comprehensive Guide for Investors

Understanding Ethereum Blockchain and Its Role in Crypto Investments

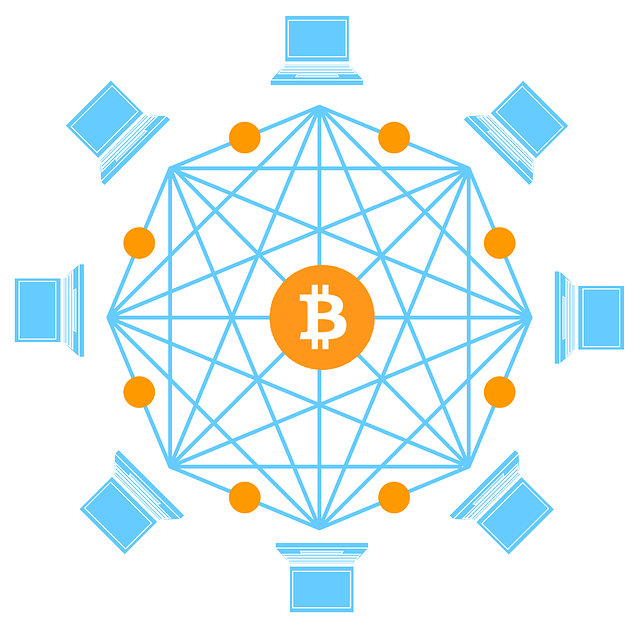

Ethereum, a decentralized blockchain network, has emerged as a powerful platform for crypto investments and beyond. Its innovative architecture allows for smart contracts—self-executing agreements that facilitate transactions without intermediaries. This feature has democratized finance, enabling peer-to-peer interactions and opening new avenues for investment during elections. By eliminating the need for traditional financial institutions, Ethereum empowers individuals to participate in transparent and secure voting processes, enhancing democratic principles.

The blockchain’s role extends beyond elections, as it provides a robust framework for decentralized applications (dApps). These apps leverage smart contracts to create trustless systems, ensuring data integrity and user privacy. As crypto investments gain traction, understanding Ethereum’s blockchain becomes pivotal. Investors can navigate this evolving landscape by embracing the technology’s potential while staying informed about its ever-changing dynamics.

The Impact of Elections on Crypto Markets: Opportunities and Risks

The volatile nature of crypto markets is well-documented, but elections can significantly amplify this volatility, presenting both opportunities and risks for crypto investors. During high-profile political events, market dynamics often shift dramatically as investors react to potential policy changes that could impact cryptocurrency adoption and regulation. For instance, election outcomes can determine the future course of blockchain technology and decentralized finance (DeFi) in various countries, influencing investor sentiment.

On one hand, a pro-crypto stance from elected officials can boost market confidence, driving up asset prices. Conversely, stricter regulatory measures or uncertainty about policy direction can lead to sharp declines. Crypto investment during elections requires careful consideration of these factors. Investors must stay informed about candidates’ views on blockchain and digital assets while also monitoring global economic trends that could affect broader market sentiment.

Developing Ethereum Applications: A Comprehensive Guide for Investors

Developing Ethereum applications offers a unique opportunity for investors looking to navigate the dynamic world of crypto. With its powerful smart contract functionality, Ethereum provides a robust platform for building decentralized apps (dApps) that can disrupt traditional industries and drive innovation during elections and beyond. This comprehensive guide aims to demystify the process for aspiring developers and investors alike.

By understanding the fundamentals of Solidity, the programming language for Ethereum, and familiarizing themselves with the Ethereum Virtual Machine (EVM), individuals can create secure and transparent dApps. The guide will walk readers through each step, from conceiving an election-focused idea to deploying and maintaining the application on the Ethereum blockchain. It emphasizes best practices for crypto investment during elections, ensuring that projects are not only profitable but also contribute to a fairer and more secure voting process.

Ethereum blockchain development plays a significant role in shaping crypto investment landscapes during elections, offering both opportunities and risks. By understanding the fundamentals of Ethereum and its applications, investors can navigate these volatile periods more effectively. The comprehensive guide provided offers valuable insights into developing Ethereum applications, empowering informed decisions in the dynamic crypto market influenced by election events.