Ethereum 2.0, through its shift from Proof of Work to Proof of Stake and implementation of sharding, aims to create a more efficient, scalable, and sustainable blockchain ecosystem for decentralized applications (dApps) and smart contracts. This evolution presents significant opportunities for crypto investment during low interest rate periods, offering enhanced user experiences and environmentally friendly solutions. Key milestones include improved transaction speeds and reduced energy consumption, positioning Ethereum as an attractive long-term investment option when traditional markets offer limited returns. The cryptocurrency market's current environment, characterized by low interest rates, drives investors towards digital assets like Ethereum 2.0, which promises increased liquidity, reduced fees, and enhanced security.

Ethereum 2.0 is poised to revolutionize the blockchain landscape, offering a more scalable, efficient, and decentralized platform. This article explores the roadmap and recent updates driving this transformative shift. We delve into key milestones, dissecting the impact of low interest rates on crypto investments against Ethereum’s evolving backdrop. Additionally, we navigate risks and opportunities for investors navigating this exciting yet uncertain era.

- Understanding Ethereum 2.0: The Next Generation Blockchain Platform

- Key Updates and Milestones in the Ethereum 2.0 Roadmap

- Impact of Low Interest Rates on Crypto Investments Amidst Ethereum's Evolution

- Navigating Risks and Opportunities for Investors in the Age of Ethereum 2.0

Understanding Ethereum 2.0: The Next Generation Blockchain Platform

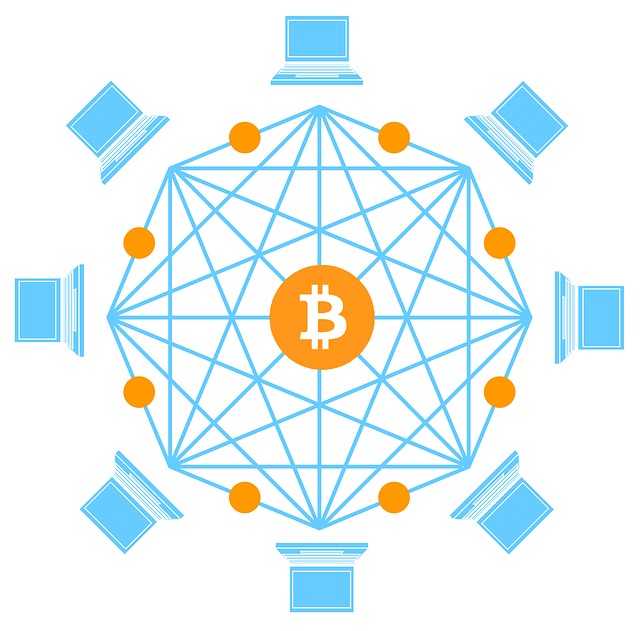

Ethereum 2.0 represents a significant evolution in blockchain technology, aiming to create a more efficient, scalable, and sustainable platform for decentralized applications (dApps) and smart contracts. By transitioning from Proof of Work (PoW) to Proof of Stake (PoS), Ethereum 2.0 seeks to address the challenges of high energy consumption and transaction fees that have plagued traditional blockchain systems. This shift not only opens up exciting opportunities for crypto investment during times of low interest rates but also promises to enhance the overall user experience, making it more accessible and appealing to a broader range of individuals and institutions.

The Ethereum 2.0 roadmap includes several key milestones aimed at achieving these goals. These include the implementation of sharding, which will enable the network to process transactions in parallel, significantly increasing its capacity. Additionally, the introduction of a new consensus mechanism based on PoS will reduce energy consumption and transaction costs, making Ethereum more environmentally friendly and cost-effective. These updates are not just technical enhancements; they signal a strategic shift towards a more decentralized, democratic, and inclusive blockchain ecosystem, which could attract new investors and drive further adoption in the crypto space.

Key Updates and Milestones in the Ethereum 2.0 Roadmap

The Ethereum 2.0 roadmap is a game-changer for crypto investors, offering significant potential amidst low-interest rate environments. One of the key updates involves transitioning to a proof-of-stake (PoS) consensus mechanism, expected to enhance scalability and energy efficiency compared to the current proof-of-work (PoW) system. This shift not only addresses environmental concerns but also makes crypto investment more accessible, especially during times when traditional financial markets offer limited returns.

Additionally, Ethereum 2.0 aims to introduce sharding, a process that divides the blockchain into smaller, more manageable pieces, allowing for faster transactions and reduced costs. This milestone is crucial for realizing Ethereum’s potential as a scalable platform for decentralized applications (dApps) and smart contracts. With these updates, crypto investors can look forward to a more robust, efficient, and secure Ethereum network, making it an attractive option for long-term investment strategies, particularly when traditional financial avenues seem less appealing due to low interest rates.

Impact of Low Interest Rates on Crypto Investments Amidst Ethereum's Evolution

In the evolving landscape of Ethereum 2.0 and the broader crypto market, the impact of low interest rates on crypto investment strategies cannot be overlooked. Traditionally, investors have turned to traditional financial instruments like bonds and savings accounts during periods of low-interest rates to maintain capital growth. However, with cryptocurrency gaining traction, many are now considering digital assets as alternative investments. This shift is particularly significant in the context of Ethereum 2.0’s promised enhancements, which could further allure investors seeking higher returns and decentralized investment opportunities.

Low interest rates create an environment where crypto investments can become more attractive due to the potential for higher returns compared to traditional savings options. As Ethereum continues its evolution with updates like sharding and proof-of-stake, it introduces new dynamics into the market. These developments could lead to increased liquidity, reduced transaction fees, and enhanced security, making crypto assets even more appealing as a hedge against inflation or a store of value. Therefore, investors may increasingly opt for crypto investments during times of low interest rates, especially with Ethereum’s growing reputation as a decentralized, innovative platform.

Navigating Risks and Opportunities for Investors in the Age of Ethereum 2.0

In the evolving landscape of cryptocurrency, Ethereum 2.0 stands as a significant milestone, promising enhanced scalability and security. As investors navigate the crypto market during times of low interest rates, understanding the risks and opportunities associated with this transition is paramount. The shift to Ethereum 2.0 involves various technical upgrades and transitions, introducing both potential pitfalls and promising prospects.

One key consideration for investors is the inherent volatility of the crypto market, especially during uncertain economic periods. Low interest rates can drive investment into riskier assets, including cryptocurrencies, but the path to Ethereum 2.0 may present temporary price fluctuations and technical challenges. However, the long-term vision of a more efficient, decentralized web offers compelling opportunities for growth and innovation. Investors who stay informed about the roadmap, key milestones, and community developments can better position themselves to capitalize on the potential rewards while managing risks effectively.

Ethereum 2.0 represents a significant evolution in blockchain technology, promising enhanced efficiency, security, and scalability. As the roadmap progresses, investors navigating the crypto space during times of low interest rates must stay informed about these updates. Understanding the potential impact on Ethereum’s ecosystem is key to making informed decisions regarding crypto investments. By embracing both risks and opportunities presented by Ethereum 2.0, investors can position themselves for success in this dynamic and rapidly evolving landscape.