In the rapidly evolving world of Ethereum DeFi opportunities, understanding default mechanisms is crucial. Default occurs when borrowers fail to repay loans, triggering smart contract actions like liquidating collateral or applying penalties, enhancing security for lenders but posing risks for borrowers. By grasping these dynamics, users can navigate the decentralized finance landscape more effectively. Smart contracts automate and streamline default resolution, reducing costs and increasing transparency. Effective strategies include robust risk assessment, decentralized credit rating systems, diverse collateralization, and interconnected liquidity pools to mitigate risks. Successful projects like Uniswap, Aave, and MakerDAO have disrupted traditional banking with automated smart contracts, promising improved security, user experiences, and global market access for the future of DeFi.

In the dynamic landscape of Decentralized Finance (DeFi), understanding default is paramount. This article delves into the intricate web of default management within DeFi, focusing on Ethereum’s pivotal role. We explore scenarios that arise in lending and borrowing, dissecting the impact of smart contracts on resolution. Furthermore, we unveil strategies to mitigate risks and present case studies showcasing Ethereum DeFi opportunities. By examining these facets, we illuminate potential paths for navigating and capitalizing on emerging financial paradigms.

- Understanding Default in DeFi: A Fundamental Concept

- Ethereum's Role in Decentralized Finance and Default Management

- Exploring Default Scenarios in DeFi Lending and Borrowing

- The Impact of Smart Contracts on Default Resolution

- Strategies for Mitigating and Managing Default Risks in DeFi

- Ethereum DeFi Opportunities: Case Studies and Future Prospects

Understanding Default in DeFi: A Fundamental Concept

In the world of decentralized finance (DeFi), understanding default is a fundamental concept, especially when exploring Ethereum DeFi opportunities. Default refers to the event where a borrower fails to repay their loan as per the agreed-upon terms. Unlike traditional financial systems, DeFi platforms operate on smart contracts, which automatically execute predefined conditions when triggered. When a borrower defaults, the smart contract initiates a series of actions, often including liquidating collateral or triggering penalties.

This mechanism provides a level of security for lenders but also carries risks for borrowers. Ethereum DeFi opportunities are characterized by innovative products that leverage this default system to create new financial instruments. By understanding how default is handled within these platforms, users can better assess the associated risks and rewards, enabling them to make informed decisions in the dynamic landscape of decentralized finance.

Ethereum's Role in Decentralized Finance and Default Management

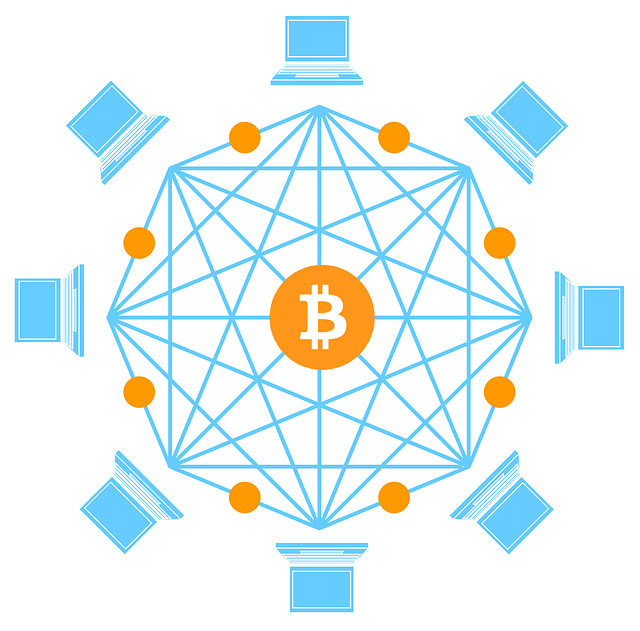

Ethereum has played a pivotal role in the growth and development of Decentralized Finance (DeFi), offering a robust infrastructure for creating innovative financial applications. Its smart contract capabilities enable automated, transparent, and trustless transactions, opening up a world of Ethereum DeFi opportunities. In this decentralized ecosystem, traditional concepts like default management are reimagined. Smart contracts, with their self-executing nature, can automate debt settlements and collateral management, reducing the risk of default and ensuring fairness among participants.

By leveraging Ethereum’s blockchain technology, DeFi platforms can create efficient systems for lending, borrowing, and insuring against defaults. This not only enhances financial inclusion but also provides borrowers with more flexible terms and better access to capital. The transparency and immutability of Ethereum’s ledger ensure that all transactions are recorded securely, promoting trust and accountability in the DeFi space.

Exploring Default Scenarios in DeFi Lending and Borrowing

In the realm of decentralized finance (DeFi), default scenarios present unique challenges and opportunities, especially in lending and borrowing. When a borrower fails to repay their loan in Ethereum DeFi platforms, it triggers a predefined set of actions designed to protect both lenders and the overall ecosystem. This process often involves smart contracts that automatically initiate repayment plans or liquidate collateral to cover the debt.

Ethereum DeFi opportunities extend beyond traditional banking models by offering more flexible and accessible financial services. Lenders can diversify their portfolios by investing in various loans, while borrowers gain access to capital without intermediaries. Understanding default mechanisms is crucial for navigators of this landscape. By embracing these scenarios as part of the ecosystem’s growth, users can contribute to shaping a robust and resilient DeFi environment.

The Impact of Smart Contracts on Default Resolution

Smart contracts have revolutionized the way default resolution is handled, particularly in the realm of Ethereum DeFi opportunities. By automating and enforcing agreements, smart contracts reduce the reliance on intermediaries, making processes faster, cheaper, and more transparent. In the context of DeFi, these contracts can facilitate lending and borrowing activities with minimal risk of default. For instance, if a borrower fails to repay their loan within the agreed-upon terms, the smart contract automatically triggers a series of actions, such as seizing collateral or initiating debt collection procedures, without the need for manual intervention.

This technology offers significant advantages in terms of efficiency and cost savings. It also promotes fairness by ensuring that both parties adhere to the set conditions. As DeFi continues to grow, the integration of smart contracts is expected to further enhance the security and reliability of financial transactions, attracting more users to explore Ethereum DeFi opportunities.

Strategies for Mitigating and Managing Default Risks in DeFi

In the dynamic landscape of Decentralized Finance (DeFi), where Ethereum has paved the way for innovative financial opportunities, default risks pose a significant challenge. Mitigating and managing these risks is crucial to fostering sustainable growth in the DeFi ecosystem. One effective strategy involves leveraging smart contracts that incorporate robust risk assessment mechanisms. These contracts can dynamically adjust lending terms based on borrower behavior and market conditions, reducing the likelihood of default. Additionally, utilizing decentralized credit rating systems, which analyze various data points beyond traditional FICO scores, enables more accurate risk profiling of borrowers.

Another key approach is the implementation of diverse collateralization strategies. By accepting a variety of assets as collateral, DeFi platforms can minimize exposure to any single asset’s volatility or potential default. Furthermore, interlinkage between different DeFi protocols, often referred to as “liquidity pools,” allows for dynamic rebalancing in case of a default event. This interconnectedness facilitates the transfer of funds from one protocol to another, ensuring that borrowers have an alternative source of liquidity and reducing overall systemic risk.

Ethereum DeFi Opportunities: Case Studies and Future Prospects

Ethereum DeFi opportunities have been transforming the financial landscape by offering a decentralized and transparent alternative to traditional finance. Case studies show that projects like Uniswap, Aave, and MakerDAO have disrupted lending, borrowing, and trading, enabling users to participate in global markets with greater control and lower barriers to entry. These platforms leverage smart contracts to automate processes, reduce intermediary involvement, and create new forms of value exchange.

Looking ahead, the future prospects for Ethereum DeFi opportunities are promising. As the ecosystem matures, we can expect to see enhanced security features, improved user experiences, and increased adoption across different sectors. Innovations in areas like decentralized exchanges (DEXs), yield farming, and stablecoins will further democratize access to financial services and open up new avenues for investment and risk management. With ongoing developments in Ethereum’s scalability and interoperability, the potential for DeFi to revolutionize global finance is set to grow exponentially.

In conclusion, this article has explored the intricate world of default within Decentralized Finance (DeFi), highlighting Ethereum’s pivotal role in managing and mitigating risks. By understanding default scenarios and leveraging smart contracts, DeFi platforms can efficiently resolve defaults and foster a thriving ecosystem. Ethereum DeFi opportunities are vast, as demonstrated by case studies, and continue to shape the future of finance, offering innovative solutions that enhance accessibility and security for all participants.