The advent of cryptocurrency, powered by blockchain technology, has significantly disrupted traditional banking systems. By offering decentralized alternatives to fiat currencies controlled by central authorities, crypto provides users with greater control over funds, eliminates intermediaries, and potentially lowers transaction costs. This democratization of finance allows global payments without bank reliance, reduces cross-border fees, and enhances international trade efficiency. Additionally, decentralized finance (DeFi) platforms offer innovative investment opportunities. The impact extends to challenging traditional banking's authority, prompting evolution and integration of blockchain solutions for competitiveness in the digital landscape. While crypto presents advantages like decentralized control and reduced fees, it also poses volatility and complex default resolutions issues without centralized oversight. Regulatory clarity is crucial for the future as blockchain technology could revolutionize transaction efficiency, security, and transparency.

The emergence of cryptocurrency has shaken up the global financial landscape, challenging the dominance of traditional banking systems. This article delves into the disruptive nature of crypto, its core principle of decentralization, and its impact on established financial structures. We explore the benefits and drawbacks of ‘default’ in crypto versus traditional banking, considering regulatory navigations and future trends. By examining these aspects, we gain insights into how cryptocurrency is reshaping our monetary systems.

- The Rise of Cryptocurrency and its Disruptive Nature

- Traditional Banking: A Historical Perspective

- How Crypto Challenges Established Financial Systems

- Decentralization: The Core Principle Behind Cryptocurrencies

- Exploring the Benefits and Drawbacks of Default in Crypto vs Traditional Banking

- Navigating Regulations and Future Outlook

The Rise of Cryptocurrency and its Disruptive Nature

The advent of cryptocurrency has shaken up the financial world, disrupting traditional banking systems and challenging long-established norms. This revolutionary digital asset, based on blockchain technology, offers a decentralized and transparent alternative to fiat currencies controlled by central authorities. The impact of crypto on traditional banking is profound, as it provides users with greater control over their funds, eliminates intermediaries, and potentially lowers transaction costs.

Cryptocurrencies’ disruptive nature lies in their ability to democratize finance. Anyone with an internet connection can participate in this new economy, sending and receiving payments globally without relying on banks or other financial institutions. This shift could lead to a significant reduction in the fees associated with cross-border transactions, making international trade more accessible and efficient. The impact of crypto is also felt in investment opportunities, as decentralized finance (DeFi) platforms offer innovative ways to borrow, lend, and earn interest, potentially providing better returns than traditional savings accounts.

Traditional Banking: A Historical Perspective

Traditional banking has a long and rich history, with roots tracing back centuries. In its early forms, banking services were often limited to wealthy elite, who would deposit their wealth in safe-keeping facilities or lend money to governments and nobles. The evolution of central banks, however, marked a significant shift. These institutions emerged as intermediaries between savers and borrowers, managing monetary policy and ensuring stability. Over time, traditional banking became more accessible to the general public, with the introduction of savings accounts, loans, and debit/credit cards.

With the advent of digital transformation and crypto, the impact on traditional banking has been profound. Crypto currencies offer a decentralized alternative, challenging the dominance of centralized financial institutions. Blockchain technology underlying crypto promises enhanced security, transparency, and faster transactions, potentially disrupting traditional banking models. While some embrace this change as a revolution, others view it with caution, recognizing both the opportunities for innovation and the risks associated with regulatory uncertainty and market volatility.

How Crypto Challenges Established Financial Systems

The emergence of cryptocurrency has significantly challenged established financial systems, prompting a reevaluation of traditional banking models. In response to the growing influence of crypto, many aspects of conventional finance have evolved or adapted to stay relevant in today’s digital landscape. The impact of crypto on traditional banking is profound; it disrupts centralized authority and fosters a more decentralized approach to money management. Blockchain technology, the backbone of cryptocurrencies, offers enhanced security, transparency, and efficiency, directly addressing long-standing issues within the financial sector.

By providing an alternative to fiat currencies, cryptocurrencies have opened up new avenues for transactions, investment, and value storage. This shift has forced traditional banks to innovate, integrating blockchain solutions into their operations to compete effectively. The convergence of crypto and finance is reshaping how we perceive and utilize money, pushing the boundaries of what’s possible in the world of financial services.

Decentralization: The Core Principle Behind Cryptocurrencies

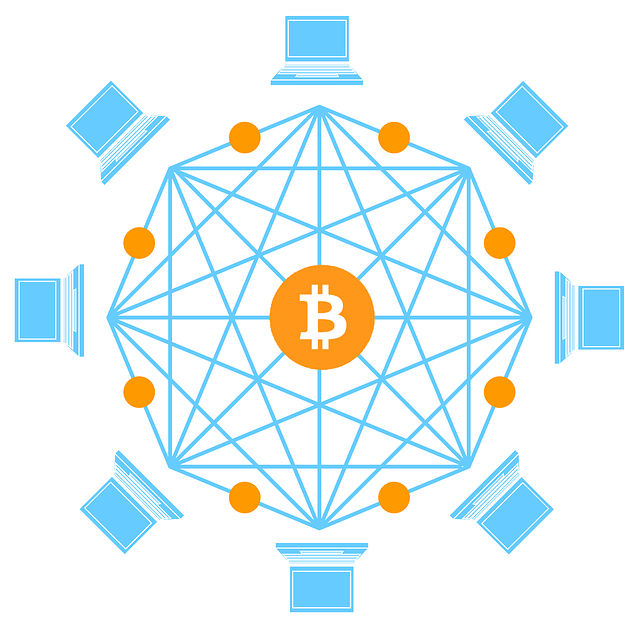

Decentralization is a core principle that drives cryptocurrencies and fundamentally alters the way financial transactions are conducted, challenging the traditional banking system. Unlike centralized banks, which control the flow of money and maintain a ledger of accounts, cryptocurrencies operate on a decentralized network, often powered by blockchain technology. This means no single entity or authority controls the currency; instead, it is managed collectively by numerous users across a global network.

The impact of this decentralization on traditional banking is profound. It reduces the need for intermediaries, such as banks, to facilitate transactions, potentially lowering fees and increasing efficiency. Crypto’s decentralized nature also enhances transparency and security through cryptography, ensuring secure and tamper-proof records. This shift towards decentralization could disrupt the status quo, forcing traditional financial institutions to adapt or risk becoming obsolete in an increasingly digital and interconnected global economy.

Exploring the Benefits and Drawbacks of Default in Crypto vs Traditional Banking

The concept of default, while often associated with financial risk, presents unique advantages in both the cryptocurrency and traditional banking sectors. In the realm of crypto, default can be a game-changer, offering decentralized control and enhanced security through blockchain technology. This revolutionary approach eliminates the need for intermediaries, potentially reducing fees and increasing accessibility for users worldwide. For instance, individuals with limited access to traditional banking services can now participate in the global economy through cryptocurrency networks.

However, navigating the crypto landscape also presents drawbacks. The volatile nature of cryptocurrencies can lead to significant financial losses if not managed carefully. Unlike regulated traditional banking systems, the lack of centralized oversight in crypto makes default resolutions more complex and time-consuming. This disparity underscores the impact of crypto on traditional banking, highlighting both its disruptive potential and the ongoing challenges it poses to established financial structures.

Navigating Regulations and Future Outlook

Navigating Regulations and Future Outlook

The rapid growth of cryptocurrency has sparked a significant debate about its impact on traditional banking systems. As regulatory bodies worldwide strive to establish clear frameworks, the future outlook for both sectors remains pivotal. The unique characteristics of crypto, such as decentralized nature and borderless transactions, present both challenges and opportunities for regulators and financial institutions alike.

One key consideration is balancing the benefits of crypto technology with the need for consumer protection and market stability. The increasing adoption of cryptocurrency could lead to a potential disruption in traditional banking models, forcing banks to adapt or risk becoming obsolete. Meanwhile, as regulatory clarity emerges, the integration of blockchain technology—the underlying infrastructure of crypto—could enhance transaction efficiency, security, and transparency across both sectors, marking a promising future for a more interconnected financial landscape.

The rise of cryptocurrency has undeniably disrupted traditional banking systems, challenging long-standing financial structures with its decentralized nature. This article has explored how cryptocurrencies, through decentralization and innovative technologies, offer both benefits and drawbacks compared to established banks. As the regulatory landscape evolves, understanding the impact of crypto on traditional banking is crucial for navigating the future of finance, ensuring consumer protection, and embracing the potential of this revolutionary technology while mitigating associated risks.