Navigating cryptocurrency taxes during geopolitical events demands a strategic approach due to market volatility and varying regulations worldwide. Savvy investors manage their crypto holdings by diversifying, meticulous record-keeping, and staying informed about regulatory shifts. Understanding the tax implications of short-term vs long-term crypto investments is key to optimizing tax efficiency. Staying compliant while minimizing tax burdens requires proactive planning, especially during global crises, where case studies offer valuable insights for successful navigation through volatile markets and diverse taxation dynamics.

“As cryptocurrency continues to gain mainstream adoption, understanding its tax implications is crucial for investors navigating this volatile market. This comprehensive guide delves into the intricate world of crypto tax liability, offering insights on managing obligations during uncertain geopolitical times. From global perspectives to optimizing strategies, we explore how short-term vs. long-term holdings impact taxes and provide real-world case studies. Discover legal tools and intelligent approaches to manage your crypto investments effectively, even amidst political upheaval.”

- Understanding Cryptocurrency Tax Liability: A Comprehensive Guide for Investors

- Geopolitical Events and Crypto: Navigating Uncertain Times with Tax Strategy

- Short-Term vs Long-Term Crypto Holdings: Tax Implications at Play

- Global Tax Perspectives on Cryptocurrency: Where Do Investors Stand?

- Optimizing Crypto Tax Obligations: Legal Strategies and Tools for Savvy Investors

- Case Studies: Real-World Examples of Cryptocurrency Tax Management During Geopolitical Crises

Understanding Cryptocurrency Tax Liability: A Comprehensive Guide for Investors

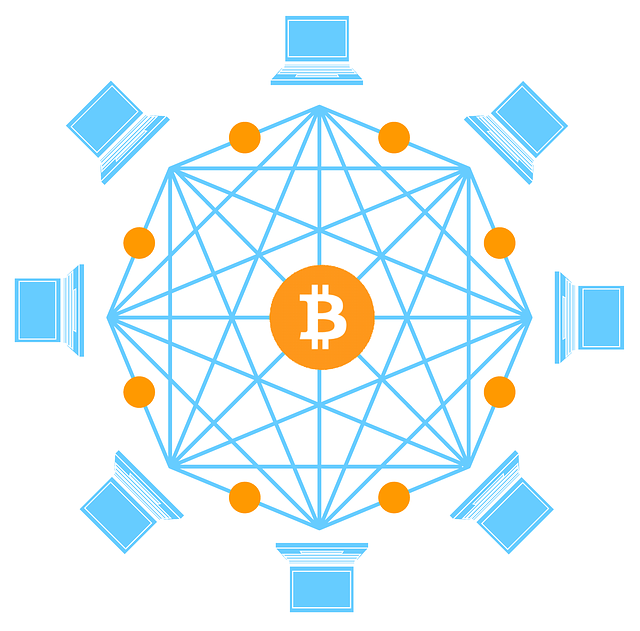

Navigating cryptocurrency tax liability is a complex task, especially during periods of heightened market volatility and geopolitical events that can significantly impact crypto investments. As more countries adopt and regulate cryptocurrencies, investors must comprehend their tax obligations to avoid penalties and ensure compliance. This comprehensive guide aims to demystify crypto tax liability for savvy investors who venture into this asset class during turbulent times.

Understanding the unique taxation of cryptocurrencies involves recognizing different types of gains or losses, keeping meticulous records of transactions, and staying informed about evolving regulations. During geopolitical events, investments in crypto can fluctuate dramatically, making it crucial to track not only the financial gains but also the timing of purchases and sales to optimize tax efficiency. By being proactive and knowledgeable about their crypto investment’s tax implications, investors can navigate these challenging scenarios with confidence and potentially reduce their overall tax burden.

Geopolitical Events and Crypto: Navigating Uncertain Times with Tax Strategy

In times of geopolitical uncertainty, cryptocurrency investors face a unique challenge—navigating volatile markets while managing tax obligations. Global events can significantly impact crypto prices, creating a complex environment for investors looking to balance their portfolios and tax strategies. As international tensions rise or economic sanctions are imposed, the value of traditional currencies and stablecoins may fluctuate, leading to significant gains or losses in cryptocurrency holdings.

During these uncertain periods, investors should consider adapting their tax planning approaches. This might involve diversifying crypto investments across different assets, keeping records of transaction details for accurate reporting, and staying informed about regulatory changes related to taxation. By being proactive and strategic, investors can mitigate potential tax liabilities while navigating the dynamic landscape of geopolitical events and crypto investments.

Short-Term vs Long-Term Crypto Holdings: Tax Implications at Play

When it comes to cryptocurrency tax implications, understanding the difference between short-term and long-term holdings is crucial for investors. Crypto investors who buy, hold, and sell assets within a year are generally taxed at ordinary income rates, reflecting their short-term investment strategies. This approach can be advantageous during volatile markets or geopolitical events, as frequent trades might help manage risks while keeping tax liabilities in check.

In contrast, long-term crypto investments, held for over a year, qualify for capital gains taxation, often at lower rates. Investors adopting this strategy, especially during periods of significant price appreciation, can benefit from substantial savings. However, it’s essential to keep detailed records and consider the potential tax consequences when navigating geopolitical events that might impact crypto markets, ensuring compliance with tax regulations.

Global Tax Perspectives on Cryptocurrency: Where Do Investors Stand?

In the dynamic landscape of global finance, crypto investment has surged during geopolitical events, reflecting a complex interplay between risk and potential reward. Tax authorities worldwide are grappling with how to regulate this nascent asset class, leading to a patchwork of regulations and varying tax perspectives on cryptocurrency. Investors navigating these waters must understand that what applies in one jurisdiction might not hold true elsewhere.

The volatility associated with geopolitical events has often correlated with increased crypto adoption, as investors seek alternative stores of value. However, this same volatility can translate into significant tax implications. Gains from crypto investments may be subject to capital gains taxes, and the tax treatment of losses can vary significantly across borders. With countries like the U.S., UK, and several Asian nations implementing stricter crypto tax rules, global investors must stay informed about these developments to ensure compliance and make informed investment decisions during these uncertain times.

Optimizing Crypto Tax Obligations: Legal Strategies and Tools for Savvy Investors

In the dynamic landscape of cryptocurrency, investors navigating complex geopolitical events can face unique tax challenges. Optimizing crypto tax obligations is a strategic must for savvy investors looking to minimize their financial exposure while staying compliant. By employing legal strategies and leveraging specific tools tailored for digital assets, investors can navigate this intricate space effectively.

One key approach involves keeping detailed records of all crypto transactions, including purchase dates, prices, and types of coins. This meticulous documentation enables precise tracking of capital gains or losses, crucial for tax calculations during volatile market periods influenced by geopolitical events. Additionally, staying informed about regulatory changes is paramount. Adapting to evolving legal frameworks ensures investors use legitimate strategies to defer taxes or take advantage of favorable legislation, especially during uncertain global scenarios where crypto’s volatility often mirrors that of traditional markets.

Case Studies: Real-World Examples of Cryptocurrency Tax Management During Geopolitical Crises

During geopolitical crises, understanding and managing cryptocurrency tax implications become even more critical as investors navigate volatile markets. Case studies from past events offer valuable insights into how crypto investors can strategize their tax management. For instance, during the 2014-2015 Ukrainian crisis, many investors shifted their focus to safer havens like Bitcoin, leading to significant gains in its value. This event highlighted the need for investors to be aware of capital gains taxes when making investment decisions during uncertain times.

Another example emerged during the COVID-19 pandemic when global stock markets experienced sharp drops. Crypto investments, on the other hand, saw a surge in popularity as investors sought alternative assets. As a result, several countries, including Canada and the United States, implemented new tax guidelines to account for the rapid growth of cryptocurrencies. These real-world scenarios underscore the importance of proactive crypto tax management during geopolitical crises, ensuring compliance while maximizing potential returns.

In navigating the dynamic landscape of cryptocurrency investment, especially during geopolitically charged times, investors must be adept at managing their tax obligations. By understanding global tax perspectives, optimizing holding strategies, and employing legal tools, crypto enthusiasts can ensure they’re compliant while maximizing returns. The case studies presented highlight real-world approaches to managing cryptocurrency taxes during crises, providing valuable insights for investors looking to weather any future storms with confidence.