Cryptocurrency, or "digital gold," has gained popularity as an alternative asset class during economic downturns due to its decentralized nature and protection against inflation and market volatility. While offering potential stores of value like traditional safe-haven assets, crypto investments come with heightened risks including extreme market volatility and lack of government oversight. Beginners should diversify their portfolios across various cryptocurrencies, conduct thorough research, and consider risk tolerance when investing. Long-term holding or short-term trading strategies can be employed depending on financial goals and risk tolerance.

“Unraveling the complex world of cryptocurrency can be daunting for newcomers. This comprehensive guide is designed to empower beginners with essential strategies for navigating the crypto market. From demystifying the fundamentals of cryptocurrency to exploring advanced tactics, we delve into effective investment approaches.

One key area of focus is understanding how to navigate economic downturns, where crypto investments offer unique opportunities. We’ll discuss risk management and diversification techniques. Additionally, this article covers portfolio construction, trading timelines, and goals, ensuring readers make informed decisions in the dynamic crypto space.”

- Understanding Cryptocurrency: The Basics for Beginners

- Crypto Investment During Economic Downturns: Opportunities and Risks

- Building a Diversified Portfolio: A Strategic Approach

- Long-Term vs Short-Term Trading: Which Strategy Fits Your Goals?

Understanding Cryptocurrency: The Basics for Beginners

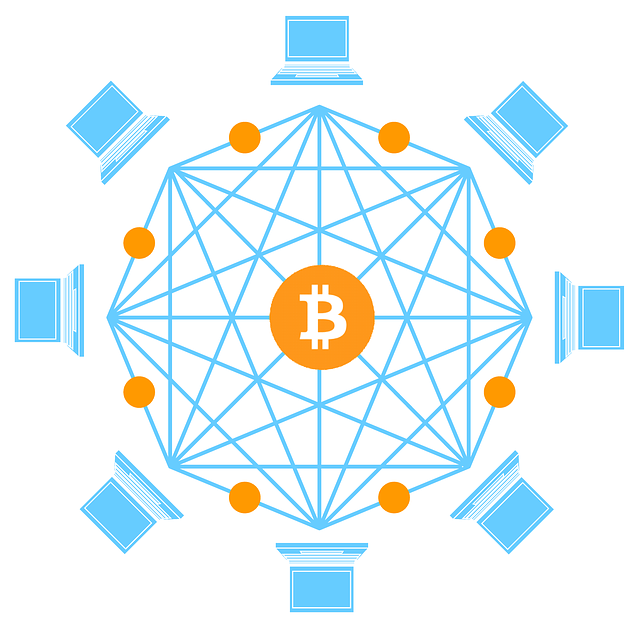

Cryptocurrency, often referred to as “digital gold,” is a revolutionary concept that has taken the financial world by storm. For beginners, understanding its fundamentals is crucial before dipping into this exciting yet complex investment arena. At its core, cryptocurrency is a form of digital or virtual currency that uses cryptography for secure transactions and control. Unlike traditional fiat currencies issued by governments, cryptocurrencies operate independently without any central authority.

During economic downturns, crypto investment has gained traction as an alternative asset class. Its decentralized nature offers a level of protection against inflation and traditional market volatility. As traditional investment options may struggle during tough economic times, cryptocurrency presents an intriguing opportunity for those seeking to diversify their portfolios. This innovative financial instrument has shown resilience in the face of economic crises, making it an attractive option for beginners looking to navigate turbulent markets.

Crypto Investment During Economic Downturns: Opportunities and Risks

When the economy takes a downturn, traditional markets can be volatile, but cryptocurrency offers an alternative asset class that may present unique opportunities for investors. During economic crises, many investors turn to safe-haven assets like gold or cash. However, cryptocurrencies like Bitcoin and Ethereum have gained attention as potential stores of value, too. Their limited supply and decentralized nature can make them attractive during times of uncertainty when central banks’ monetary policies may be in question.

While crypto investments can provide a hedge against inflation and offer the prospect of substantial gains, they also come with heightened risks. Market volatility is extreme, and prices can fluctuate dramatically. The lack of government or institutional oversight means that protection against fraud or market manipulation is limited. Beginners should approach crypto investment during economic downturns with caution, conducting thorough research and considering their risk tolerance before diving in.

Building a Diversified Portfolio: A Strategic Approach

Building a diversified portfolio is an essential strategy for cryptocurrency investors, especially during economic downturns. In the volatile crypto market, spreading your investments across various assets can help mitigate risks. Instead of putting all your funds into one coin or token, consider a range of cryptocurrencies with differing use cases and levels of market capitalization. Diversification ensures that a potential downturn in one asset’s value doesn’t sink your entire portfolio.

During economic downturns, some sectors may struggle while others thrive. Cryptocurrencies tied to specific industries or with innovative technologies can offer unique opportunities. For instance, investing in stablecoins or cryptocurrencies focused on financial services might prove more resilient during tough economic times. A strategic approach involves thorough research and understanding of each crypto’s fundamentals, including its development team, roadmap, and community support. This way, you build a portfolio that not only diversifies risk but also has the potential for growth even when traditional markets are facing challenges.

Long-Term vs Short-Term Trading: Which Strategy Fits Your Goals?

When it comes to crypto investment strategies, understanding the difference between long-term and short-term trading is crucial for beginners. Long-term investing involves holding cryptocurrencies for an extended period, often years or even decades, with the goal of capital appreciation as the primary focus. This strategy aligns well with those looking to build wealth over time, especially during economic downturns when prices might be lower, offering opportunities for significant gains in the long run.

On the other hand, short-term trading, also known as swing trading or day trading, entails frequent buying and selling within a shorter period, typically from days to weeks. This approach demands close market monitoring and quick decision-making. While it can be risky, it provides potential for higher returns in a shorter time frame. Beginners should consider their risk tolerance and financial goals before choosing between these strategies, as both have unique advantages and challenges in the dynamic crypto investment landscape.

For beginners navigating the world of cryptocurrency, understanding both its potential and inherent risks is key. In particular, crypto investment during economic downturns presents unique opportunities due to market volatility. By building a diversified portfolio and adopting a strategic approach that aligns with your financial goals – whether focusing on long-term growth or short-term trades – you can navigate this dynamic landscape with confidence. Remember, while cryptocurrency offers exciting prospects, thorough research and a well-considered strategy are essential for success.