Trader AI revolutionizes finance with automated market insights through artificial intelligence, but investors must remain vigilant against scams like the Astral Edge fraud. While legitimate AI applications enhance market understanding and decision-making, high-risk investments promised by cutting-edge technology can lead to significant losses. To avoid pitfalls, verify track records, seek user testimonials, consult regulatory bodies, and steer clear of platforms promising guaranteed profits. Differentiating between legitimate services and scams is crucial for safeguarding personal financial investments in the evolving AI landscape.

“In recent years, the financial world has witnessed a surge in Artificial Intelligence (AI) applications, particularly in trading. This article delves into the intriguing landscape of Trader AI and its potential to revolutionize automated market insights. We explore the promise and pitfalls, with a critical eye towards the infamous Astral Edge scam. Learn how to identify similar AI-driven investment frauds and discover legitimate ways AI is reshaping financial markets. By understanding these dynamics, investors can navigate the digital realm more effectively.”

- Understanding Trader AI and Its Promise of Automated Insights

- The Rise and Fall of Astral Edge: Unveiling the Scam

- How to Spot and Avoid Similar AI-Based Investment Scams

- Exploring Legitimate Uses of AI in Financial Markets

Understanding Trader AI and Its Promise of Automated Insights

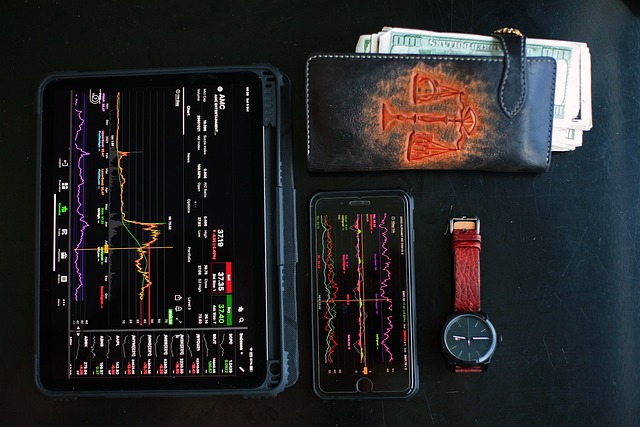

Trader AI represents a groundbreaking advancement in the financial world, offering automated market insights that promise to transform trading strategies. This innovative technology leverages artificial intelligence to analyze vast amounts of data, identify patterns, and generate actionable recommendations—all within fractions of a second. Unlike traditional methods that rely heavily on manual analysis and human intuition, Trader AI aims to remove subjective bias and enhance decision-making processes with scientific rigor.

The allure of Trader AI lies in its potential to deliver consistent and unbiased insights, ensuring traders stay ahead of the curve. However, it’s crucial for investors to approach this technology with caution, especially in light of concerns surrounding potential Astral Edge scams. With promises of revolutionary trading tools, some entities may exploit the enthusiasm of aspiring traders. Therefore, thorough research and verification are essential before committing resources to any AI-based trading platform, ensuring both the integrity of the technology and the security of personal financial investments.

The Rise and Fall of Astral Edge: Unveiling the Scam

In recent years, the financial world has witnessed a surge in AI-driven trading tools, promising investors unprecedented insights and profits. Among these, Astral Edge emerged as a shining star, claiming to revolutionize the market with its advanced algorithms and predictive capabilities. The platform boasted of delivering automated trades based on complex AI analysis, enticing investors with the prospect of substantial gains with minimal effort. Many were lured by the promise of consistent profitability and quick returns, especially those seeking an edge in the ever-volatile stock market.

However, as quickly as Astral Edge rose to fame, it also fell from grace. Numerous reports and investigations began surfacing, exposing the platform for what it truly was—a sophisticated scam. It turned out that behind the glamorous facade of AI innovation, Astral Edge employed fraudulent practices, manipulating data and generating false insights to lure unsuspecting investors. The promise of easy wealth proved too tempting for some, leading to significant financial losses for many who believed in the platform’s capabilities. This case serves as a stark reminder of the importance of caution when it comes to investing, especially with the emergence of seemingly innovative but potentially harmful tools like Astral Edge scam.

How to Spot and Avoid Similar AI-Based Investment Scams

When considering AI-driven investment opportunities, it’s crucial to remain vigilant and ensure the legitimacy of the source. Many promising yet fraudulent schemes, like the Astral Edge scam, have emerged, preying on investors’ hopes for quick returns. One effective strategy is to verify the track record of the AI system; legitimate traders will often provide detailed performance histories and testimonials from satisfied users. Additionally, consult regulatory bodies or industry experts for insights into the company’s reputation and any pending investigations.

Another red flag might be excessive promises of guaranteed profits or get-rich-quick schemes. Reputable AI trading platforms focus on providing valuable insights and tools to enhance decision-making rather than making absurd claims. It’s also essential to understand that while AI can offer powerful analytical capabilities, it doesn’t eliminate risk; successful investing still requires careful consideration of market dynamics and personal financial goals.

Exploring Legitimate Uses of AI in Financial Markets

In recent years, Artificial Intelligence (AI) has emerged as a game-changer in financial markets, offering unprecedented opportunities for traders to gain insights and make informed decisions. However, it’s crucial to navigate this digital landscape with caution, especially when faced with promises of revolutionary tools like Trader AI. Unlike some so-called Astral Edge scams that may flood the market, legitimate uses of AI in financial markets enhance analysis by processing vast data points swiftly and accurately. These include identifying complex patterns, predicting market trends, and automating trading strategies to reduce human error.

By leveraging machine learning algorithms, AI systems can adapt and improve over time, ensuring traders access up-to-date information. This technology empowers investors to stay ahead of the curve, especially in volatile markets. However, it’s essential to source AI tools from reputable providers who prioritize data security and transparency, avoiding potential pitfalls associated with fraudulent schemes.

In conclusion, while Trader AI and automated market insights offer promising potential, it’s crucial to be vigilant against scams like the fallen Astral Edge. By understanding these technologies and learning to identify fraudulent schemes, investors can navigate the digital landscape with greater confidence. Legitimate applications of AI in financial markets hold significant value, but caution and informed decision-making are paramount to ensuring a safe and successful investment journey, avoiding the pitfalls of AI-based scams like Astral Edge.