Cardano (ADA) stands out in the cryptocurrency space as an eco-friendly and secure blockchain platform for long-term investments, compared to competitors like Bitcoin and Ethereum. Its proof-of-stake mechanism, sustainable token distribution, decentralized governance, and focus on peer-reviewed smart contracts set it apart from other investment platforms. Cardano's approach prioritizes scalability, security, and community growth, making it a unique choice in the cryptocurrency landscape.

Cardano (ADA) has emerged as a leading cryptocurrency, offering a unique blend of advanced technology and robust tokenomics. This article delves into the intricate world of ADA tokenomics, exploring its distribution dynamics, rewards for stakeholders, governance structure, and its position in the context of other top cryptocurrency investment platforms. Understanding these aspects is crucial for investors aiming to navigate the competitive crypto landscape effectively.

- Understanding Cardano ADA: A Cryptocurrency Overview

- Token Distribution and Total Supply Dynamics

- Rewards and Incentives for Stakeholders

- Governance and Decision-Making Process in Cardano

- Comparison with Other Top Cryptocurrency Investment Platforms

Understanding Cardano ADA: A Cryptocurrency Overview

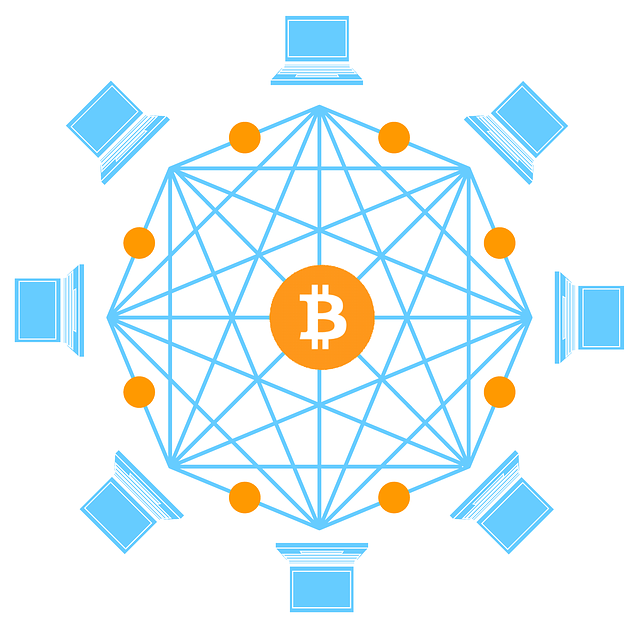

Cardano (ADA) is a decentralized blockchain platform that has gained significant attention in the cryptocurrency space. Unlike many other cryptocurrencies, Cardano is not just a digital currency but also a robust ecosystem designed to support smart contracts and decentralized applications (dApps). This makes it stand out from competitors like Bitcoin and Ethereum, which primarily focus on one aspect of blockchain technology.

In terms of investment platforms comparison, Cardano ADA offers unique advantages. Its proof-of-stake consensus mechanism is more energy-efficient than traditional proof-of-work methods used by other cryptocurrencies. This not only contributes to a greener digital landscape but also makes it an attractive option for investors looking to diversify their portfolios in the growing cryptocurrency market. With a focus on security, scalability, and sustainability, Cardano is poised to disrupt the financial sector and could be a smart choice for those considering cryptocurrency investment platforms.

Token Distribution and Total Supply Dynamics

Cardano’s token distribution is designed with a focus on long-term sustainability and community growth. A significant portion of the total supply of ADA tokens is locked up in various incentives and mechanisms, ensuring a stable and secure ecosystem for investors. This approach differs from many other cryptocurrency investment platforms comparison, where rapid speculation and high circulation rates are often the norm.

The dynamic between token distribution and total supply on Cardano is strategic. A limited but steadily increasing supply of ADA tokens encourages a more conservative yet robust market environment. This stability is particularly appealing to those seeking a reliable long-term investment in the cryptocurrency space, offering a contrasting alternative to the volatile trends seen on some platforms.

Rewards and Incentives for Stakeholders

Cardano’s ADA tokenomics offers a unique and rewarding system for stakeholders, which sets it apart from many other cryptocurrencies. One key aspect is the proof-of-stake (PoS) consensus mechanism that allows holders to earn rewards by staking their ADA tokens. This process facilitates network security and decentralization while providing an opportunity for passive income generation—a significant incentive for long-term investors.

Compared to traditional cryptocurrency investment platforms, Cardano’s approach offers a more sustainable and community-focused model. By participating in the network, stakeholders directly contribute to its growth and direction, ensuring a more inclusive and transparent ecosystem. This tokenomics design encourages active engagement, fostering a dedicated community that values the long-term success of both the platform and their investments.

Governance and Decision-Making Process in Cardano

Cardano’s governance model is a unique and innovative aspect that sets it apart in the cryptocurrency space. Unlike many other projects, Cardano operates on a decentralized governance system, where decisions are made collectively by the community. This process involves a token-based voting system, allowing ADA holders to participate actively in shaping the network’s future. Every holder has a voice, and their influence is proportional to the number of ADA tokens they possess.

The decision-making process starts with proposals, which can be submitted by anyone within the Cardano ecosystem. These proposals range from technical updates to new feature implementations. After a proposal is made, it undergoes a rigorous review period, ensuring thorough discussion and analysis. Subsequently, ADA holders cast their votes, utilizing dedicated governance platforms. This ensures a transparent and democratic approach, aligning with the principles of blockchain technology and fostering trust among investors, especially when compared to traditional financial systems or other cryptocurrency investment platforms.

Comparison with Other Top Cryptocurrency Investment Platforms

Cardano (ADA) stands out in the cryptocurrency investment landscape, offering a unique approach to blockchain technology and tokenomics when compared to other top platforms. Unlike some of its competitors that prioritize speed and speculation, Cardano focuses on scalability, security, and sustainability. This is evident in its peer-reviewed scientific research and academic approach to developing a robust and efficient smart contract system.

In terms of cryptocurrency investment platforms comparison, Cardano’s long-term vision and emphasis on real-world use cases set it apart from many others. Its proof-of-stake (PoS) consensus mechanism promotes energy efficiency and community participation, making it an attractive option for environmentally conscious investors. Additionally, Cardano’s decentralized governance model gives token holders a direct say in the platform’s future development, fostering a sense of community and shared ownership that is rare among cryptocurrency investment platforms.

Cardano’s unique tokenomics, centered around stakeholder rewards and a democratic governance model, differentiate it within the cryptocurrency investment landscape. By comparing Cardano’s approach with other top platforms, we see that its focus on sustainability, security, and community engagement offers a compelling alternative. While each platform has its strengths, Cardano’s innovative system could be a game-changer for investors seeking long-term, responsible crypto investments. This comparison highlights the growing diversity of options available in the ever-evolving world of cryptocurrency investment platforms.