The gaming industry has embraced crypto and NFTs, providing players with new levels of ownership and transparency. Blockchain technology ensures the rarity and authenticity of digital assets, creating new revenue streams for developers. As cryptocurrency adoption grows, navigating complex crypto tax reporting is crucial. A crypto tax reporting guide offers insights into global regulations and best practices, helping gamers and developers maintain meticulous transaction records for accurate tax returns, fairness, and minimizing legal risks.

“Welcome to the revolutionary world of blockchain gaming, where digital entertainment meets decentralized technology. This article explores the emerging ecosystem that is transforming the gaming industry. We delve into the potential of blockchain, highlighting its impact on crypto and NFT integration in games. Furthermore, we navigate the complex legal and regulatory landscape, offering a comprehensive crypto tax reporting guide. By examining economic opportunities and challenges, readers will gain insights into the future sustainability of this innovative sector.”

- Understanding Blockchain Gaming: A New Frontier in Digital Entertainment

- The Rise of Crypto and NFT Integration in Games

- Navigating the Legal and Regulatory Landscape for Crypto Tax Reporting

- Building a Sustainable Future: Economic Opportunities and Challenges in the Blockchain Gaming Ecosystem

Understanding Blockchain Gaming: A New Frontier in Digital Entertainment

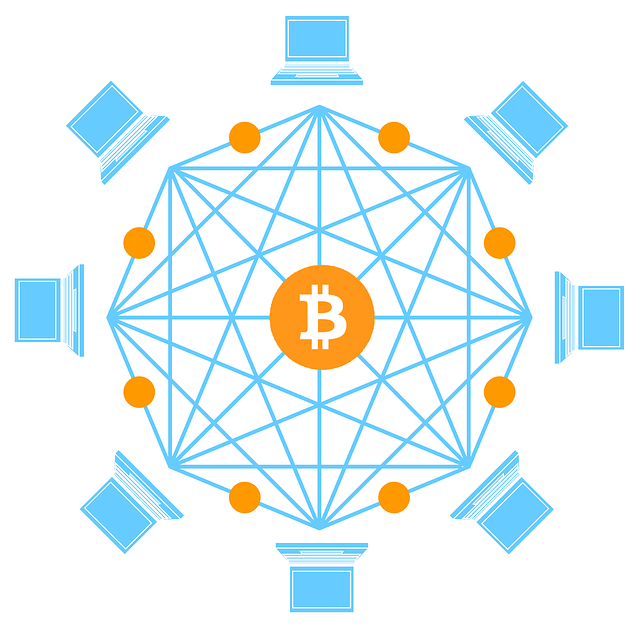

Blockchain gaming represents a groundbreaking shift in digital entertainment, offering players a new level of ownership and interactivity within virtual worlds. This innovative ecosystem leverages decentralized technology to create immersive experiences where gamers can not only play but also contribute to the game’s economy by owning unique assets, such as NFTs (Non-Fungible Tokens). Each transaction, from item purchases to in-game trades, is recorded on a transparent and secure blockchain, ensuring fair play and reducing fraud.

In this new frontier, crypto tax reporting guide becomes an essential tool for gamers who earn cryptocurrency rewards or sell NFT assets. As the blockchain gaming industry grows, so does the complexity of managing these digital earnings, requiring gamers to stay informed about tax implications and compliance regulations. By understanding how blockchain technology works and adopting proper crypto tax practices, players can navigate this exciting new frontier while ensuring they remain within legal boundaries.

The Rise of Crypto and NFT Integration in Games

In recent years, the gaming industry has witnessed a significant shift with the integration of crypto and NFTs, revolutionizing how players interact with games. This new wave of technology brings a level of ownership and transparency never seen before in virtual environments. Non-Fungible Tokens (NFTs) allow gamers to purchase unique digital assets, such as in-game items or characters, which are verified on a blockchain network, ensuring their rarity and authenticity. As a result, players can truly own these assets, trade them, or use them as collateral for financing within the game economy.

The rise of crypto and NFTs in gaming also opens doors to new revenue streams for developers. Crypto tax reporting guides have become essential tools to help gamers and developers navigate the complex financial landscape surrounding these digital assets. With blockchain technology’s ability to record every transaction transparently, it simplifies the process of tracking income, calculating taxes, and ensuring compliance. This integration not only adds a new layer of security but also creates a more sustainable and profitable ecosystem for all participants involved in the gaming community.

Navigating the Legal and Regulatory Landscape for Crypto Tax Reporting

Navigating the legal and regulatory landscape for crypto tax reporting is a complex yet essential aspect of the blockchain gaming ecosystem. As the adoption of cryptocurrencies grows, so does the need for clear guidance on taxation. Gamers and developers who participate in this space must be aware of their obligations to report cryptocurrency transactions accurately. A crypto tax reporting guide becomes an invaluable tool, offering insights into global regulations and best practices.

Understanding the legal framework is crucial to ensure compliance. Different jurisdictions have varying rules regarding crypto taxes, including mining rewards, in-game purchases, and non-fungible token (NFT) sales. Gamers must keep detailed records of their transactions, including dates, amounts, and types of cryptocurrencies exchanged. This data will be vital when filing tax returns or facing potential audits. By staying informed about these regulations, participants in the blockchain gaming ecosystem can mitigate legal risks and ensure they contribute fairly to global tax systems.

Building a Sustainable Future: Economic Opportunities and Challenges in the Blockchain Gaming Ecosystem

The blockchain gaming ecosystem is poised to revolutionize the entertainment industry, offering a sustainable future filled with economic opportunities. As crypto continues to gain mainstream adoption, the integration of blockchain technology in gaming presents a unique value proposition. In-game assets can be tokenized and traded on decentralized exchanges, fostering a new economy where players can own and monetize their virtual possessions. This shift promises increased transparency, reduced transaction fees, and enhanced player autonomy.

However, navigating this nascent landscape comes with challenges. The current crypto tax reporting guide is still evolving, leaving developers and investors unsure about compliance requirements. Additionally, ensuring the security of smart contracts and decentralized applications is paramount to building consumer trust. Overcoming these hurdles will be crucial for the long-term success and widespread adoption of blockchain gaming.

The blockchain gaming ecosystem presents an exciting new frontier, merging digital entertainment with crypto and NFT integration. As this industry navigates the complex legal and regulatory landscape of crypto tax reporting, it also holds immense economic potential. While challenges exist, a sustainable future for blockchain gaming is within reach, offering innovative opportunities that could revolutionize digital play. For investors and enthusiasts alike, understanding this evolving ecosystem is key to staying ahead in the world of blockchain gaming. This crypto tax reporting guide highlights the importance of navigating these complexities to ensure long-term success.