Adopting tech-savvy crypto investment strategies involves breaking free from traditional financial thinking. Cryptocurrencies thrive in a volatile, fast-paced environment with constant technological advancements and decentralized governance. Embracing this mindset allows investors to explore new opportunities, adapt to market changes, and use cutting-edge tools. While following established strategies has its allure, it might hinder recognizing dynamic trends in crypto markets. To succeed, investors should start with default approaches but remain adaptable, tailoring their strategies to individual risk tolerances and emerging crypto landscape opportunities.

In today’s digital era, crypto investments offer both allure and pitfalls. This article explores the “default” mentality behind crypto strategies, revealing common pitfalls when letting automatic settings dictate choices. We delve into tech-savvy approaches to overcome these limitations, such as active risk management, customizing portfolio allocation, utilizing advanced features like cold storage, and staying informed about market trends. Discover how to navigate this dynamic landscape for optimal security and returns.

- Understanding the Default Mentality in Crypto Investments

- – The allure and pitfalls of letting default settings guide investment strategies

Understanding the Default Mentality in Crypto Investments

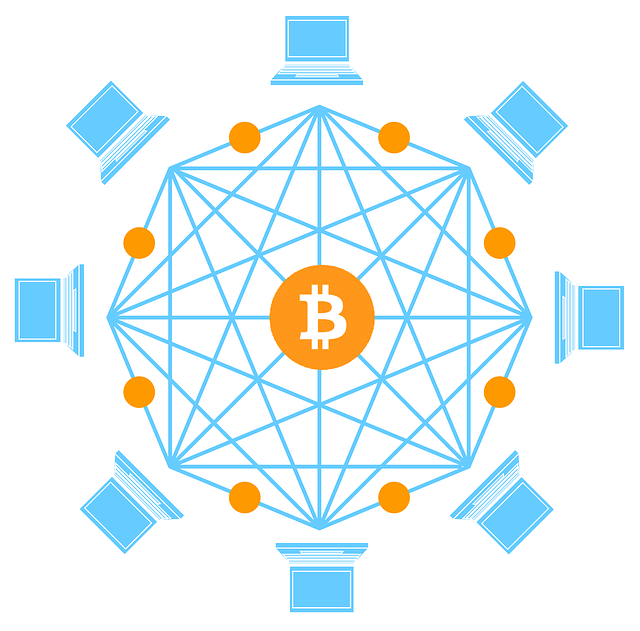

In the realm of crypto investments, adopting a tech-savvy approach demands an understanding of the default mentality. Default, here, refers to the tendency to rely on conventional wisdom or previous experiences when navigating uncharted digital territories. Many investors, accustomed to traditional financial markets, may approach cryptocurrency with preconceived notions about risk and reward structures. Overcoming this default mindset is crucial for embracing innovative tech-savvy crypto investment strategies.

This shift involves recognizing that cryptocurrencies operate within a distinct ecosystem characterized by volatility, rapid technological advancements, and decentralized governance. Investors who embrace this new default mentality are more likely to explore diverse investment opportunities, adapt to changing market dynamics, and leverage cutting-edge tools and platforms. By doing so, they position themselves for potential gains in this dynamic and ever-evolving digital financial landscape.

– The allure and pitfalls of letting default settings guide investment strategies

Using tech-savvy crypto investment approaches can be both appealing and perilous when considering default settings. On one hand, relying on default strategies offers convenience and leverages existing algorithms designed by seasoned investors. This path is often recommended for beginners, as it minimizes the learning curve and potential losses while allowing them to gain experience with minimal risk.

However, the allure of defaults can cloud judgment and lead to suboptimal results. Crypto markets are notoriously volatile and dynamic, requiring strategies that adapt to changing conditions. Sticking to default settings may fail to account for emerging trends, unique investment opportunities, or individual risk tolerances. As such, while defaults provide a starting point, they should be viewed as a foundation to build upon rather than a rigid blueprint for success in the ever-evolving world of cryptocurrency investment.

When adopting tech-savvy crypto investment approaches, understanding and managing the default mentality is key. While letting default settings guide strategies may seem convenient, it can also lead to unexpected pitfalls. By actively evaluating and adjusting your methods, you can navigate the complex landscape with greater confidence, ultimately enhancing your investment journey. Remember that conscious decision-making, backed by thorough research, is the true path to success in this dynamic realm.