“Dive into the world of Bitcoin mining hardware, a crucial component for crypto investment strategies targeted at long-term growth. This comprehensive guide navigates the evolution of mining equipment, from past technologies to future prospects. We dissect performance metrics, energy consumption, and cost analysis, offering insights for investors. Understanding hardware efficiency is key to optimizing returns in today’s dynamic crypto landscape.”

- Understanding Bitcoin Mining Hardware: A Gateway for Long-Term Investors

- The Evolution of Mining Equipment: Past, Present, and Future Technologies

- Performance Metrics: How to Evaluate Mining Hardware Efficiency

- Energy Consumption and Sustainability in Bitcoin Mining Operations

- Cost Analysis: Investing in Hardware for Optimal Long-Term Returns

Understanding Bitcoin Mining Hardware: A Gateway for Long-Term Investors

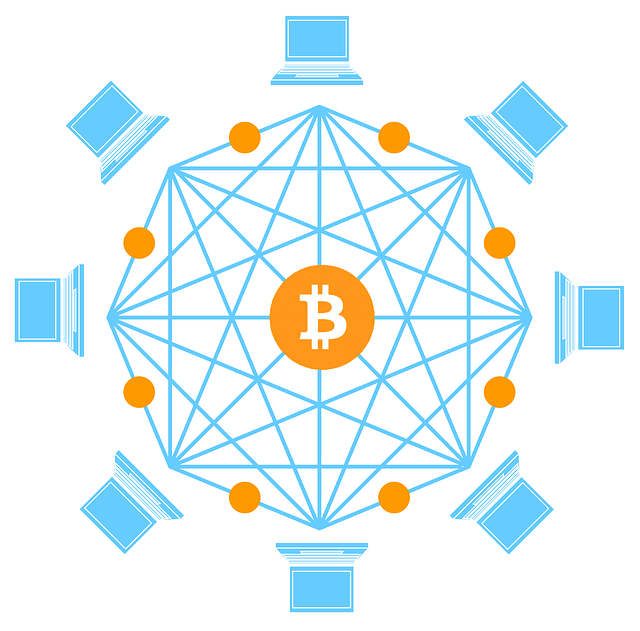

Understanding Bitcoin mining hardware is a crucial step for any long-term investor in crypto. It’s more than just choosing a machine; it’s unlocking the potential for sustained profitability within the Bitcoin ecosystem. The right hardware acts as a gateway, enabling investors to navigate the ever-evolving mining landscape and capitalize on strategic opportunities. By considering factors like hash rate, energy efficiency, and computational power, investors can make informed decisions that align with their crypto investment strategies for the long haul.

For instance, advancements in ASIC (Application-Specific Integrated Circuit) technology have dramatically increased Bitcoin mining efficiency. These specialized chips are designed specifically to solve the complex mathematical problems required for mining, making them significantly more powerful and energy-efficient than general-purpose GPUs or CPUs. Embracing these innovations allows investors to not only stay competitive but also contribute to the broader sustainability of the Bitcoin network, a key consideration in long-term crypto investment strategies.

The Evolution of Mining Equipment: Past, Present, and Future Technologies

The evolution of Bitcoin mining hardware has mirrored the rapid growth and changing landscape of cryptocurrency itself. In the early days, individual miners used their CPUs and GPUs for solving complex mathematical problems. This period was marked by accessibility and a relatively low barrier to entry, attracting many enthusiasts who viewed it as both a fun hobby and a potential crypto investment strategy. As Bitcoin’s popularity surged, specialized ASIC (Application-Specific Integrated Circuit) hardware emerged, offering significant performance advantages over general-purpose devices. This shift transformed mining from a decentralized, community-driven activity into a more concentrated space, with specialized farms dominating the market.

Looking ahead, the future of Bitcoin mining equipment promises to be shaped by further technological advancements. The development of more efficient and powerful chips, along with improved cooling solutions, could enhance mining capabilities while reducing energy consumption—a critical factor for both environmental sustainability and cost-effective crypto investment strategies. Additionally, cloud mining services are gaining traction, allowing individuals to participate in the process remotely, further democratizing access to this once specialized field.

Performance Metrics: How to Evaluate Mining Hardware Efficiency

When comparing Bitcoin mining hardware, understanding performance metrics is key for crypto investors looking into long-term strategies. Efficiency isn’t just about the raw hashing power—it’s a complex interplay between the device’s hash rate, energy consumption, and cost. Hash rate measures how many computations per second a miner can perform, reflecting its processing speed. Lower energy consumption per gigahash (GH/W) indicates a more energy-efficient hardware, crucial for sustainable crypto investment as it minimizes operational costs over time.

Additionally, the cost of mining equipment is a significant factor in any crypto investment strategy. High-performance ASICs, for example, offer superior efficiency but come at a premium price. Long-term investors should consider not just the upfront cost but also the return on investment (ROI) potential based on current and projected market conditions, as well as the hardware’s adaptability to future mining difficulty levels and algorithm updates.

Energy Consumption and Sustainability in Bitcoin Mining Operations

Bitcoin mining, an energy-intensive process, has sparked debates about its environmental impact and sustainability. As a crypto investment strategy, understanding energy consumption is vital for long-term investors. The mining hardware’s efficiency in processing transactions while minimising power usage is crucial. Modern Bitcoin miners employ advanced technologies like ASICs (Application-Specific Integrated Circuits) to enhance performance and reduce energy costs.

The choice of mining equipment plays a significant role in determining the overall environmental footprint. Investors should consider machines with higher power efficiencies, as these can lead to substantial cost savings and contribute to more sustainable Bitcoin mining operations. This is especially important given the ever-evolving crypto landscape where long-term strategic planning, including eco-friendly practices, might just be the game-changer that attracts environmentally conscious investors.

Cost Analysis: Investing in Hardware for Optimal Long-Term Returns

Investing in Bitcoin mining hardware is a strategic move for long-term crypto investors, as it directly impacts profitability and return on investment (ROI). The cost analysis involves considering not just the initial purchase price but also operational expenses. High-performance ASIC miners, while more expensive upfront, offer superior hash rates and energy efficiency, leading to potentially higher long-term gains. These advanced machines are designed for optimal mining performance, reducing the time required to generate valid blocks and increase overall network security.

For frugal investors, mid-range GPUs or even CPU-based solutions might seem appealing due to lower initial costs. However, these options often have shorter lifespans and may not be as energy-efficient, resulting in higher operational expenses over time. A thorough analysis of power consumption, cooling requirements, and maintenance should be part of any crypto investment strategy, especially for those adopting long-term strategies. Opting for hardware with a good balance between performance and cost can ensure sustainable mining operations, contributing to consistent and healthy returns.