In volatile crypto markets, effective investment strategies are vital. This includes long-term holding, dollar-cost averaging, arbitrage, and derivatives trading. Diversifying across multiple cryptocurrencies reduces risk, while adaptive strategies respond to market shifts. Upgrading mining hardware and software enhances efficiency. Dynamic risk management, diversification, technical analysis, and understanding tailored crypto strategies help investors make informed decisions, maximizing gains and minimizing losses in this dynamic digital assets landscape.

“Explore the dynamic world of cryptocurrency mining pools and their profitability potential. This comprehensive guide uncovers essential insights for crypto enthusiasts aiming to maximize returns. From understanding the basics of mining pools to navigating market volatility, we delve into strategic techniques. Discover how factors like pool size, coin choices, and network difficulty impact profits. Learn advanced trading tactics to diversify your crypto investments and mitigate risks associated with volatile markets, refining your crypto investment strategies for maximum stability.”

- Understanding Cryptocurrency Mining Pools: A Basic Overview

- Factors Influencing Mining Pool Profitability

- Strategies for Optimal Pool Participation: Maximizing Returns

- Risk Assessment: Volatility and Its Impact on Crypto Investments

- Diversification: Spread Your Bets in the Crypto Market

- Advanced Trading Techniques for Navigating Volatility

Understanding Cryptocurrency Mining Pools: A Basic Overview

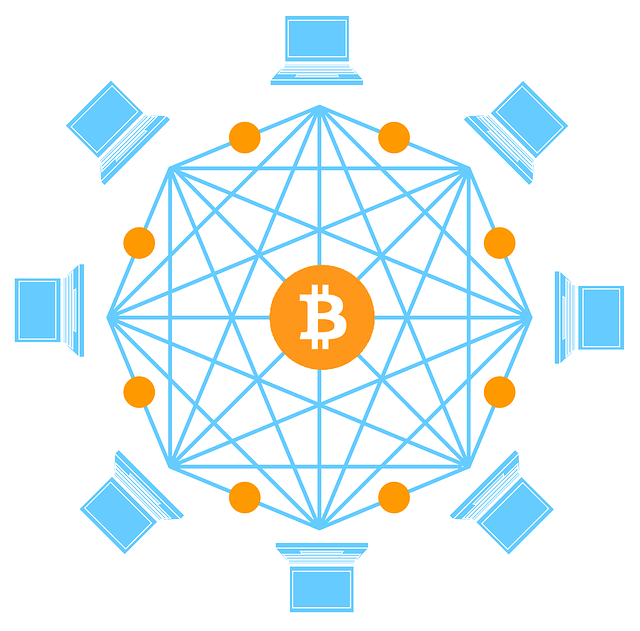

Cryptocurrency mining pools have emerged as a collaborative effort among miners aiming to enhance their collective computing power and maximize profits in the ever-evolving crypto market. These pools facilitate the combination of resources, allowing individuals with less powerful hardware to participate effectively. By pooling resources, members gain access to larger blocks and more frequent rewards, which can be particularly beneficial during periods of high market volatility. This collaborative approach democratizes the mining process, enabling a diverse range of investors to participate in crypto investment strategies.

Understanding the dynamics of these pools is crucial for navigating the complexities of the cryptocurrency landscape. Miners contribute their computing power to solve complex mathematical equations, known as hashing, to validate transactions and create new blocks on the blockchain. The pool then distributes rewards among participants based on their individual contributions. This system encourages collaboration and promotes efficient resource utilization, providing a stable and profitable environment for crypto investors looking to mitigate the effects of market volatility.

Factors Influencing Mining Pool Profitability

Strategies for Optimal Pool Participation: Maximizing Returns

To maximize returns in a cryptocurrency mining pool, participants should adopt strategic approaches that navigate market volatility. Diversifying investments across multiple cryptocurrencies is a key strategy, as different coins have varying levels of stability and growth potential. This spread reduces risk; if one crypto experiences a downturn, others might offset those losses. Adaptive investment strategies that respond to market shifts are also crucial. Monitoring trends, staying informed about upcoming protocol changes, and quickly adjusting asset allocation can capitalize on volatile fluctuations.

Additionally, efficient pool participation involves optimizing hardware and software resources. Upgrading mining rigs with the latest technology ensures maximum hash rates and enhances overall efficiency. Utilizing specialized mining software that optimizes block solving processes further boosts profitability. Regularly updating firmware and security measures is vital to protect against vulnerabilities and maximize the secure processing of transactions.

Risk Assessment: Volatility and Its Impact on Crypto Investments

In the realm of cryptocurrency mining pool profitability, understanding risk assessment is paramount. One of the most significant factors to consider is market volatility, which can dramatically impact crypto investments. Cryptocurrency markets are known for their unpredictable nature, with prices fluctuating rapidly over short periods. This volatility presents both opportunities and challenges for investors adopting various crypto investment strategies.

Volatility can be a double-edged sword. On one hand, it allows for significant gains when prices surge, making it an attractive aspect of cryptocurrencies. However, the same unpredictability can lead to substantial losses if market shifts occur suddenly. Therefore, successful crypto investors must develop robust risk management strategies tailored to their tolerance levels. Implementing measures such as diversifying portfolios and employing technical analysis tools can help navigate market volatility, ensuring more stable returns in the long term.

Diversification: Spread Your Bets in the Crypto Market

Advanced Trading Techniques for Navigating Volatility

Navigating cryptocurrency markets is akin to sailing through uncharted waters, characterized by unpredictable tides and swift currents. This volatility presents both challenges and opportunities for investors. Advanced trading techniques are essential tools in this dynamic landscape. One powerful strategy involves implementing dynamic risk management, adjusting positions swiftly based on real-time market data. Diversification is another key; spreading investments across various cryptocurrencies can help mitigate risk, ensuring that a single downturn doesn’t sink your entire portfolio.

Additionally, leveraging technical analysis to identify trends and patterns allows traders to anticipate price movements. Indicators like moving averages, relative strength index (RSI), and Bollinger bands offer valuable insights into market sentiment and potential turning points. Combining these techniques with a robust understanding of crypto investment strategies for market volatility equips investors to make informed decisions, maximizing gains while minimizing losses in the ever-changing world of digital assets.

In conclusion, navigating the cryptocurrency mining pool landscape involves a blend of strategic understanding, risk management, and diversification. By delving into these concepts, from the basics of crypto mining pools to advanced trading techniques, investors can optimize their participation in this dynamic market. Adopting proactive strategies, such as diversifying investments and employing sophisticated volatility-mitigation tactics, is essential for successful crypto investment amidst market fluctuations. Embracing these principles equips individuals with robust tools to weather volatility and potentially maximize returns within the ever-changing realm of cryptocurrency investing.