In cryptocurrency trading, Market Sentiment Analysis is a vital tool for understanding and leveraging market defaults that significantly impact trade execution, pricing, and liquidity. By integrating real-time data with historical trends, traders can anticipate market volatility and make strategic decisions to optimize portfolio performance while mitigating default risks through diversification and agile strategy adjustments based on public sentiment.

In the dynamic realm of cryptocurrency trading, understanding ‘default’ is paramount. This article delves into a key concept—default in crypto trading—essential knowledge for investors navigating this volatile landscape. We explore market sentiment analysis, crucial tools and techniques for gauging crypto market moods, and its impact on portfolio management. Additionally, we present strategies to minimize default risks, equipping traders with insights to make informed decisions in the ever-changing world of cryptocurrencies. “Market sentiment analysis for crypto traders” becomes a powerful weapon in their arsenal.

- Understanding Default in Crypto Trading: A Key Concept Explained

- Market Sentiment Analysis: Tools and Techniques for Cryptocurrency Traders

- The Impact of Default on Crypto Portfolio Management

- Strategies to Minimize Default Risks in Cryptocurrency Investments

Understanding Default in Crypto Trading: A Key Concept Explained

In the realm of cryptocurrency trading, understanding default is pivotal. Default refers to a pre-set behavior or outcome that occurs when no other action is taken. In crypto, it often manifests as a predefined setting in smart contracts or exchanges, influencing market dynamics and user experiences. For instance, a default order type might automatically execute trades at the best available price, streamlining transactions but potentially missing out on more favorable price points.

Market sentiment analysis for crypto traders heavily relies on deciphering these defaults. By recognizing how pre-set parameters impact trade execution, pricing, and liquidity, traders can make informed decisions. Adjusting default settings based on individual strategies and market conditions can enhance trading efficiency, mitigate risks, and ultimately influence overall portfolio performance.

Market Sentiment Analysis: Tools and Techniques for Cryptocurrency Traders

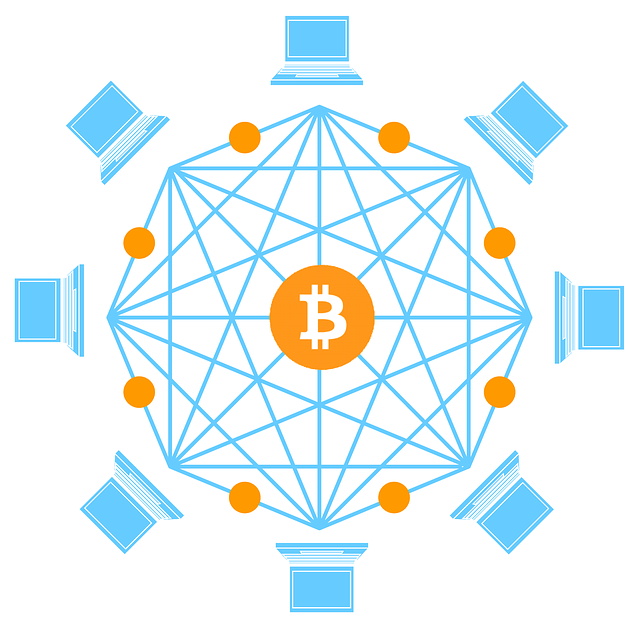

Market Sentiment Analysis plays a pivotal role in guiding cryptocurrency traders’ decisions, offering insights into collective investor attitudes and market trends. This powerful tool helps traders navigate the volatile crypto landscape by understanding the dominant emotions and expectations of the market. By employing advanced algorithms and natural language processing (NLP), traders can analyze vast amounts of data from social media platforms, news articles, forums, and other online sources to gauge sentiment towards specific cryptocurrencies.

Tools for Market Sentiment Analysis in cryptocurrency trading include specialized software packages that integrate with popular exchange APIs, allowing real-time data feeding and automated sentiment scoring. These platforms leverage machine learning models trained on historical market data and sentiment labels to predict future price movements based on current sentiment trends. Techniques such as text classification, sentiment scoring, and topic modeling enable traders to identify dominant narratives surrounding cryptocurrencies, enabling them to make more informed trading decisions.

The Impact of Default on Crypto Portfolio Management

In the dynamic landscape of cryptocurrency, default can have a profound impact on portfolio management. As markets experience volatility, investors must navigate turbulent waters to preserve and grow their digital assets. Default risk, a key consideration for crypto traders, refers to the potential for a loss if an asset’s price drops below a predetermined threshold. This risk is exacerbated by the highly speculative nature of cryptocurrencies and their sensitivity to market sentiment analysis.

Crypto portfolio managers employ various strategies to mitigate default risk, including diversifying across multiple assets, setting stop-loss orders, and staying abreast of industry trends and regulatory changes. Market sentiment analysis for crypto traders plays a crucial role in anticipating price movements and making informed decisions to avoid default. By understanding the collective mood and attitudes of investors, traders can gauge potential upsurges or downturns in asset values, enabling them to adjust their portfolios accordingly.

Strategies to Minimize Default Risks in Cryptocurrency Investments

To minimize default risks in cryptocurrency investments, crypto traders should employ robust market sentiment analysis tools. By delving into real-time data and historical trends, traders can anticipate potential volatility and make more informed decisions. Sentiment analysis helps identify dominant public opinions, allowing investors to gauge the overall market health. This strategy is crucial for navigating the unpredictable nature of cryptocurrencies.

Additionally, diversification plays a significant role in mitigating default risks. Investors should spread their portfolios across various assets, including stablecoins and tokens with strong fundamentals. Regularly updating investment strategies based on sentiment analysis results can further enhance risk management. Crypto traders who stay agile and adapt to market shifts are better positioned to protect their investments from potential defaults.

In navigating the volatile landscape of cryptocurrency trading, understanding default as a key concept and implementing effective market sentiment analysis tools are essential. By discerning the impact of default on portfolio management, investors can employ strategies to minimize risks. Through a combination of thorough sentiment analysis and proactive risk management, crypto traders can make more informed decisions, ensuring their investments are protected against potential defaults in this dynamic digital era. This approach is crucial for those seeking to thrive, not just survive, in the ever-changing world of cryptocurrency trading.